BOOK REVIEWS

Steering the Belt and Road’s Energy Mix: A Steering Theory Perspective on Chinese Energy Investments in Pakistan and Indonesia

Hannes Gohli is a post-doctoral scholar in the Chair of China Business and Economics, University of Würzburg, Germany. Sinologie Universität Würzburg, Am Hubland, 97074 Würzburg, Germany (hannes.gohli@uni-wuerzburg.de).

Introduction

The 7th of September 2013 was a special day for Nazarbayev University in Astana, Kazakhstan (Maçães 2019). From behind a delegation of officials, the audience watched China’s president Xi Jinping deliver a speech that introduced “an innovative approach to build an economic belt along the Silk Road”.[1] The speech launched the initial component of a gigantic infrastructure plan that along with the “Twenty-first Century Maritime Silk Road” would later be known as the Belt and Road Initiative (BRI) (Clarke 2017). Following Xi’s speech, it took the Chinese government two years to issue the “Vision and Actions on Jointly Building the Silk Road Economic Belt and the Twenty-first Century Maritime Silk Road” (hereafter “Vision”),[2] which has since become the Action Plan on the Belt and Road Initiative (Zhao et al. 2019: 133). The Vision, jointly issued by the National Development and Reform Commission (NDRC), the Ministry of Foreign Affairs (MFA), and the Ministry of Commerce (MOFCOM), lays out principles and cooperation priorities for the BRI.

Among the many industries listed in the Vision, energy infrastructure has seen the largest inflow of Chinese finance.[3] Directed by ministerial decrees, two Chinese policy banks have contributed approximately the same amount of capital as foreign direct investment (FDI) from commercial banks and private investment combined (Ma 2020). Between 2014 and 2017, 43% of energy sector loans from the China Development Bank (CDB) and Export-Import Bank (EXIM) were dedicated to expanding fossil fuels such as oil, gas, and petroleum (Zhou et al. 2018). During the same period, 7% of funds were earmarked for long-distance transmission projects, while the remaining 50% were dedicated to electricity generation via coal (19%), nuclear (14%), hydro (11%), solar (3%), and wind (3%) (ibid.). Since 2017, investments in electricity generation have dropped precipitously and experienced a volte-face in terms of sectoral distribution, not least due to the marked decrease in finance from China’s policy banks (Lin and Bega 2021). Expenditure on renewables along the BRI overtook coal for the first time in 2020, with the CDB and EXIM contributing no new development finance along the Belt and Road in 2021 and 2022.[4]

Yet, legacy spending on fossil fuels has led to divergent patterns of energy extraction among countries participating in the BRI (Li, Gallagher, and Mauzerall 2020). Boston University’s (BU) China Global Energy Finance (Gallagher 2021a) and China Global Power (Gallagher 2021b) databases offer an interactive breakdown of Chinese development finance in the energy sector worldwide. The databases show how financing outflows from China have fluctuated over time and that the heterogeneity of investments in energy sources varies from one recipient country to the next (Lin and Bega 2021). These patterns have been observed by others (Zhou et al. 2018; Li, Gallagher, and Mauzerall 2020; Lin and Bega 2021), and most recently by Liu, Hale, and Urpelainen (2023), who attribute dissimilar investment flows to Pakistan and Indonesia to the strength of the domestic fossil fuel lobby at the micro-level, transnational governance at the meso-level, and high politics at the macro-level. Other actor-centred contributions focus on host-country perceptions (Tritto 2021), domestic policy design, as well as prevalent sociopolitical institutions (Haris, Yang, and Bi 2022).

This study seeks to add to actor-centred discourse analyses by analysing MOFCOM’s role in steering outward energy investments that result in a more or less heterogenous energy mix in Pakistan and Indonesia. More importantly, the aim is not to challenge others’ explanations, but to explore an additional angle of investigation that analyses the communication patterns of one of China’s central ministries in charge of BRI-related policy design. Building on BU’s databases (Gallagher 2021a, 2021b) and findings from others’ discourse analyses (Tritto 2021; Liu, Hale, and Urpelainen 2023), the study adopts steering theory to show how one of China’s steering subjects concerned with designing BRI-related investment policy (the MOFCOM) uses steering modes to guide objects’ (e.g., state-owned or private enterprises) outward investments in electricity generation. To establish steering modes along a continuum from hard (command and control) to soft (negotiated), the research combines quantitative and qualitative document analysis with hermeneutic practices described in the sociology of knowledge approach to discourse (SKAD) (Keller 2007). Based on the analysis of 281 MOFCOM publications (see primary sources), the article uncovers recurring utterances (Schünemann 2018) that steer objects’ decision-making on energy investments in Pakistan and Indonesia. As documented by Liu, Hale, and Urpelainen (2023), the selection of Pakistan and Indonesia is conditioned on the two countries being members of the BRI, their centrality in MOFCOM policies, as well as sufficient data available on different types of Chinese energy investments (Gallagher 2021a, 2021b).

The structure of the article is as follows. The theoretical framework chronicles the interplay between subjects, objects, and steering modes as central tenets of steering theory. A brief methodology then exposes the methodological decisions taken to harvest, sort, code, and structure data. Thereafter, the findings track the frequency and context of key utterances as part of the study’s quantitative and qualitative document analysis. The discussion juxtaposes findings with theoretical prescriptions to explain divergent energy mixes in Pakistan and Indonesia. Finally, the conclusion revisits the article’s major contributions and offers suggestions for future research.

The theoretical framework

Steering theory

Steering theory analyses the role of state intervention to steer resource allocation, structural reconfiguration, and power relations in society (Mayntz 1987). Steering theorists understand society as a system of functionally differentiated subsystems (Luhmann 1987) in which the political subsystem captures, prioritises, and responds to other subsystems’ wants, demands, and supports (Easton 1965). The theory posits that subsystems consist of aggregated actors, whose ability to steer distinguishes them as either subjects capable of steering or objects affected by subjects’ impulses (Scharpf 2000). Steering is defined as an intervention into the natural operation of a system that transforms a hierarchy from one state of being to another. But because resource constraints affect subjects’ ability to steer, they must prioritise which wants, demands, and supports to respond to. Additionally, subjects’ ability to steer may be affected by turf wars and/or power brokering with other subjects capable of steering, as well as varying levels of resistance on the part of objects capable of self-steering (Mayntz 1990). Individual objects can also join interest coalitions to extend the reach of their self-steering abilities and thereby influence policy design (negotiation) and implementation (counter-steering).

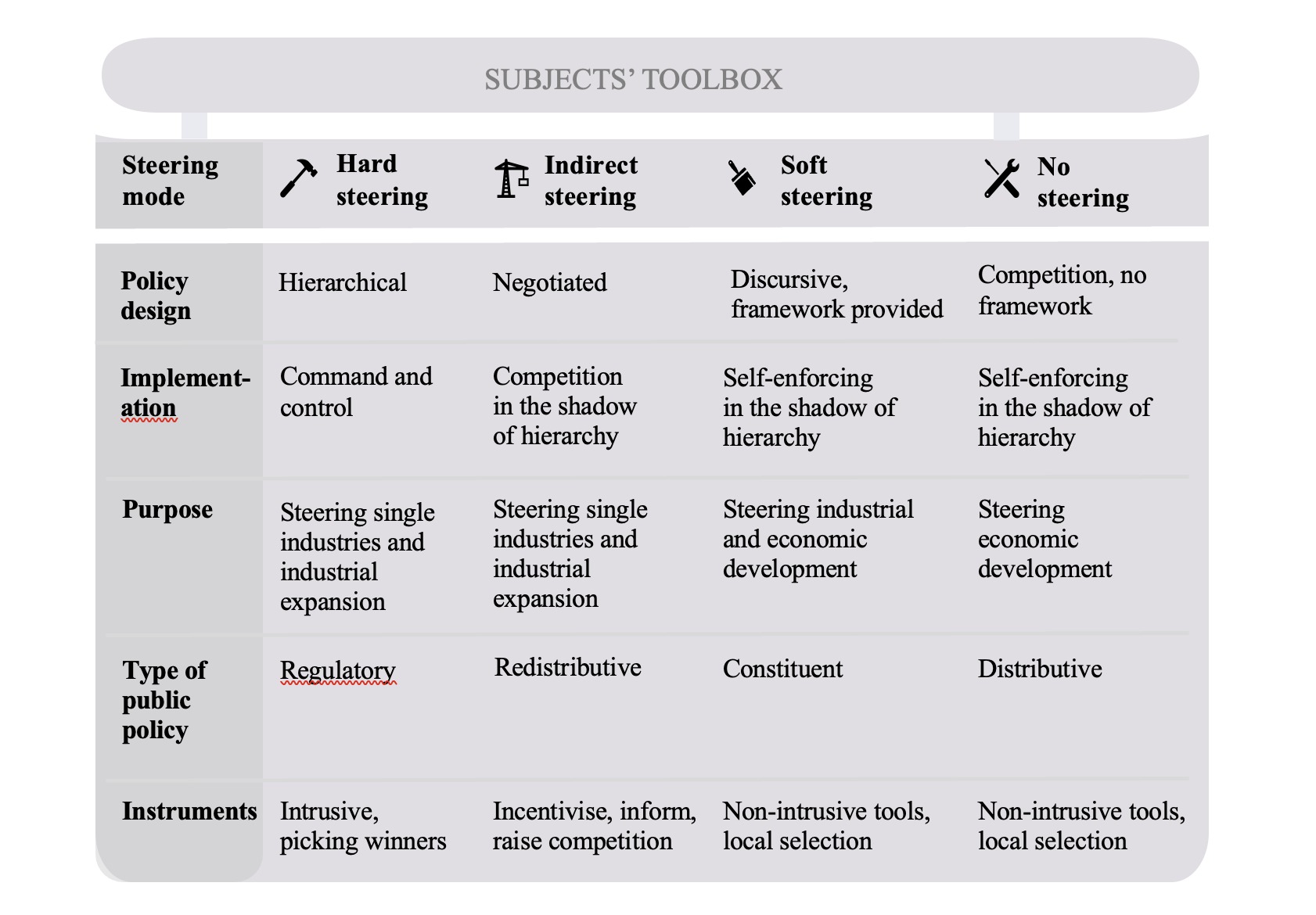

Steering theory recognises not only subjects’ varying abilities to steer, but also the need to adapt steering to objects’ acceptance of or resistance to steering (Schubert and Alpermann 2019). Should subjects decide to instigate or adjust a steering initiative, they can do so by deploying instruments and modes as necessary to suit the rationality of the targeted subsystem (Willke 2014). Depending on their desire for control, subjects embed instruments (such as public policy and associated tools) in modes of steering along a hard-soft continuum for the purpose of changing objects’ behaviour. Hard steering is the most hierarchical mode of steering in which subjects retain the greatest degree of control over policy design, instrument selection, and implementation (Scharpf 2000). Harder modes of steering are associated with more coercive instruments (e.g., negative lists) that force objects to modify their behaviour. When objects are invited to negotiate on subjects’ proposed intervention, but instrument selection remains in the subjects’ domain, then steering theorists speak of indirect steering. Discursive practices are also a key ingredient in soft modes of steering, which differ from indirect steering in that objects are given agency in instrument selection and policy implementation. Subjects’ close supervision then casts a shadow of hierarchy over the implementation process, a shadow objects are mindful of while devising solutions (Börzel and Risse 2010). Finally, no steering reflects a total transferral of steering agency to objects, whose expertise subjects trust to the extent that they renounce control over instrument selection and policy implementation entirely (Fischer, Gohli, and Habich-Sobiegalla 2021).

By embedding policy instruments in modes of steering, subjects intentionally or unintentionally affect the structural set-up of actor coalitions in, and the allocation of, resources across subsystems (Mayntz 1987). Whether via contestation for sole decision-making power, joint-steering, or self-steering, bargaining among subjects and objects for steering capacity also affect state/market relations (Schubert and Alpermann 2019). Coercion associated with different steering modes leads subjects to adopt a specific type of public policy[5] (and associated instruments) in connection with hard and soft modes of steering (Figure 1).[6] The command and control nature of hard modes is best suited to regulatory policies, in which subjects’ vertical intervention imposes positions and rule-based obligations on objects (Anderson 1997). By inviting objects to participate in policy design, indirect modes incentivise objects by bestowing status upon those invited to negotiations, similar to the proclivity of redistributive public policies to reallocate goods or power (Heckathorn and Maser 1990). Soft modes of steering, meanwhile, can be most closely associated with constituent public policies, for although objects are granted freedoms to select tools for implementation, subjects continue to provide a framework, i.e., rules about rules (Lowi 1985), that confers authority only as long as objects continue to support subjects’ vision for society, i.e., shadow of hierarchy (Scharpf 2000). Finally, no steering is best paired with distributive public policies that unconditionally bestow privileges for the local selection of tools to individual objects (Heckathorn and Maser 1990).

Figure 1. Steering modes, public policy types, and instruments

Source: author’s design based on Fischer, Gohli, and Habich-Sobiegalla 2021.

Steering China’s Belt and Road Initiative

Given that BRI is “China’s main foreign policy” since 2013 (Schulhof, van Vuuren, and Kirchherr 2022: 2), it should come as no surprise that the Chinese state casts a watchful eye over resource allocation in its projects. And yet, despite the initiative’s elevated importance, “the Chinese government lacks an integral governance framework that systematically coordinates all relevant institutions” (Sampson, Wang, and Valderrama 2021: 59). Instead, BRI financing is coordinated, promoted, and executed by a “dizzying array of actors” (Schneider 2021: 18) both within and outside of China, each trying to identify the right subjects from which to gain agency and extract resources. In terms of determining subjects, public policies such as the Vision have helped analysts concentrate central government decision-making for trade-related BRI issues in the MFA, NDRC, and MOFCOM.[7] At the same time, a growing body of literature shows that local governments, provincial and municipal state-owned enterprises’ (SOEs) branches, and private enterprises regularly reinterpret BRI guidelines to suit their own interests (Zeng 2019).

BU’s databases reveal that certain deal types and investors are more prevalent in some sectors of the BRI than in others (Gallagher 2021b), a pattern others have identified and sought to explain for Pakistan and Indonesia (Liu, Hale, and Urpelainen 2023). Despite a similar number of projects (27 in Pakistan and 26 in Indonesia), Chinese capital flows into Pakistan’s energy sector produce a range of ventures in all but geothermal generation, while 98% of investments in Indonesian power are concentrated in coal. Scholars have identified a range of push and pull factors that contribute to these diverging investment patterns. On the supply side, these include push factors such as Chinese overcapacities in coal and policy banks reluctant to fund renewables abroad (Kong and Gallagher 2019). On the demand side, Indonesia’s comparatively vast coal reserves, competitive market, and developmental attitude (Tritto 2021), as well as domestic policy preferences, private interests (ibid.), and its degree of institutional integration in the BRI (Liu, Hale, and Urpelainen 2023), are pull factors that lead to relatively less heterogenous Chinese investment patterns in Indonesia’s energy mix.

On top of sectoral divergencies, the type of Chinese investments also differs between the two countries. At 43% of total capacity, coal is the most popular destination for Chinese capital in Pakistan, followed by hydro (19%), nuclear (19%), gas (14%), solar (3%), wind (1%), and oil (1%). In terms of the structure of funding, most capacity instalments in Pakistan are financed via greenfield investments (49%), with coal accounting for the majority (87%) of this deal type. Interestingly, no coal projects in Pakistan are solely financed by policy banks, yet in Indonesia, the majority of coal extraction is funded either purely (48%) or in combination with the EXIM or CDB (30%). While Chinese investments in Pakistani dams are spread between greenfield investments (42%), policy banks (31%), and FDI (27%), the country’s two nuclear power plants with Chinese involvement are exclusively funded by the EXIM. Mergers and acquisitions (M&As) are the preferred mode of investment in gas (80%) and oil (100%), while greenfield investments are the only deal type deployed for solar and wind parks in Pakistan. The comparatively miniscule Chinese investments in Indonesian hydropower (110 MW or 1% of total capacity) and gas (93 MW or 1% of total capacity) are funded by the EXIM for the former and M&As for the latter energy source.

When a deal is structured as FDI, greenfield investment, or M&As, then a greater number of Chinese actors register capital in Pakistan than in Indonesia (Gallagher 2021b). In both countries, however, SOEs dominate capital streams into energy projects, although diversity exists with respect to power source (Liu, Hale, and Urpelainen 2023). Of the 14 Chinese companies undertaking investments in Pakistan’s power sector, 12 are state-owned, one is a private enterprise (Zhenfa New Energy), and one possesses a mixed-ownership structure (ZTE). The latter private or mixed enterprise greenfield investments are responsible for Chinese capital in Pakistani solar power, with SOEs’ attention focused on coal (63%), gas (13%), hydro (12%), oil (11%), and wind (1%). The company that adds the most to Pakistan’s energy supply is the state-owned State Power Investment Corporation (SPIC) (4,996 MW), whose investments cover all Chinese capital inflows in oil and 80% of funding in gas. Despite playing no role in Pakistan’s energy sector, Shenhua contributes the lion’s share of investment in Indonesia (43%), along with seven other state-owned enterprises. China Huadian (1,666 MW or 26%) and China Datang (1,543 MW or 24%) are other major players in Indonesia’s coal-laden energy sector. Based on the cases of Pakistan and Indonesia, in the following, the study will investigate how MOFCOM, one of many Chinese subjects involved in the BRI, adopts different steering modes to guide funds into the two countries’ energy sector.

Material and methods

Against a constructivist philosophical background (Murphy 1997), the sociology of knowledge approach to discourse (SKAD) guided decision-making on harvesting, sorting, and analysing data (Keller 1997). SKAD seeks to capture how language and social practices affect power/knowledge relations, resource allocation, and institutional structures (Foucault 1974). Due to SKAD’s focus on text-based analysis, Keller’s (1997) prescriptions are optimally suited to capturing recurring utterances and instruments in government policies. As with steering theory, the ultimate aim is not to find causal explanations, but rather to capture utterances that provide a platform for theorising on a discourse under investigation (Schünemann 2018). For the present study, discursive limitations were set in terms of industry, geography, and time: we identified utterances in Chinese public statements on resource allocation in Pakistan and Indonesia’s energy sectors from the issuance of the BRI to December 2022.

With discursive barriers in place, SKAD directs researchers to build their data corpus dynamically and reflectively (Keller 2007). For this study, the data corpus initially consisted of 772 public posts, including policies, notifications, and news items issued by MOFCOM. After a preliminary scan that excluded documents unrelated to Chinese investment in Pakistan or Indonesia’s energy sectors, the final collection consisted of 281 documents.[8] The decision to focus on MOFCOM was guided by the Ministry’s central position in BRI administration and by characteristics of the website’s search function (Zhao et al. 2019). As such, explorations filtered results according to countries (Pakistan and Indonesia), sectors (energy and electricity), and time (7 September 2013 to 31 December 2022). The 164 results for Pakistan and 117 decrees for Indonesia were then inserted into a single MAXQDA project, where they were sorted chronologically and coded according to generation methods before being analysed quantitatively and qualitatively to identify recurring utterances. The objective for deploying mixed methods is to first quantitatively identify utterances that occurred most frequently across documents before contextualising these utterances via qualitative analysis. Recurring utterances were counted, sorted, and finally juxtaposed with Lowi’s (1985) public policy framework and steering modes.

Despite continuous reflection, several limitations impacted the quality of the data collected. First, SKAD’s primary methodological shortcoming is that the framework fails to explain at what point saturation is reached (Corbin and Strauss 2008). Even though a large number of decrees were collected, the sample does not constitute all legislation that could have affected subjects’ selection of steering modes. Second, SKAD’s constructivist mindset places a heavy emphasis on the researcher’s interpretation of utterances, even though SKAD legitimises hermeneutics by emphasising researchers’ ability to rely on formal interpretation techniques (Keller 2007). Document analysis of the utterances on resource allocation on Pakistan and Indonesia’s energy sector ultimately resulted in 665 utterances for Pakistan and 614 utterances for Indonesia, which were sorted into the categories of banks, instruments, actors, and energy source. Utterances in the category of instruments, the most central to connecting Lowi’s (1985) typology to steering theory, were then further segmented, based on utterances’ intention, level of intrusiveness, and subjects’ perceived degree of control. Third, the selection of MOFCOM as a single steering subject paints a distorted picture of policy-making in China, where a large number of ministries, policy banks, export credit agencies, and state-owned enterprises (at the central and local level) contribute to the design and implementation of state legislation (Shen and Power 2017). Furthermore, MOFCOM’s de facto steering capacity cannot be extracted from document analysis, an implementation bias connected to steering theory that others have identified in different settings (Fischer, Gohli, and Habich-Sobiegalla 2021). Finally, even though MAXQDA can dissect, code, and scrutinise Chinese characters, it is not designed for this purpose, which may have resulted in utterances left unidentified by the software’s lexicographic search function.

Results

Quantitative analysis of utterances

In terms of energy source, utterances connected to coal (e.g., “coal,” “fire coal,” and “coal electricity”) dominate MOFCOM publications on Pakistan and Indonesia’s energy sector. For Pakistan, 160 utterances could be identified in approximately 10% of the documents analysed. Among other generation methods, solar also features prominently in Pakistan, with 97 utterances appearing in approximately 9% of the communications. More general terms for renewables, such as “sustainable energy,” “new energy,” or “clean energy” appear an additional 62 times in 6% of records, less than direct references to solar (N = 97). Wind energy receives little attention in MOFCOM publications, registering only nine utterances in less than 1% of reports. In comparison, natural gas, nuclear, and hydroelectricity’s 35, 25, and 23 utterances are comparable in quantity, but still inferior to oil, which receives 67 mentions in approximately 6% of documents scrutinised. Generation via geothermal sources and biomass are not mentioned at all in MOFCOM’s public communications directed at Pakistan’s energy sector.

While the absolute number of utterances for “coal” is the highest in Indonesia (N = 142), as a share of documents (18%), coal is surpassed by the utterance “new energies,” which is raised in 23% of MOFCOM publications. Due to Indonesia’s status as a major global oil exporter, the prominence of oil (N = 90) in 16% of publications should not come as a surprise. A more unexpected quantitative finding is how close utterances on “solar” (N = 87) come to rivalling oil-related terms in absolute figures. However, at 11%, statements on solar are far more concentrated in fewer documents. Natural gas (N = 36), nuclear (N = 35), and geothermal (N = 25) energy also feature, but only in 5% of documents. Wind energy (N = 4), meanwhile, receives next to no attention in MOFCOM publications directed at Indonesia, despite the country’s propitious geographical and climatic conditions. Similar disregard is paid to the country’s water resources, which appear only 5 times as a source for electricity generation.

To compare the type of attention the two countries’ energy systems receive in MOFCOM communications, Table 1 offers a juxtaposition of the five most prominent single energy-source utterances in Pakistan and Indonesia, including their frequency, as well as absolute and relative weights, measured by the number of documents in which the terms are mentioned. It shows that utterances related to fossil fuels appear twice in Pakistan’s (“coal electricity” and “fire coal”) and three times in Indonesia’s (“coal,” “fuel,” and “oil price”) top five utterances.[9] An utterance connected to coal is the highest statement in both countries, with “coal” registering nearly double the absolute frequency as the second highest utterance in Indonesia. “Photovoltaic” is present in both countries’ top five, but a look at the quantity and percentage of documents that register the term shows that only a few publications concentrate on solar, but apparently in a highly intensive fashion.

Table 1. Top five utterances for Pakistan and Indonesia

| Pakistan’s five most prominent utterances | Absolute quantity | Quantity of documents | Percentage of documents containing utterances | |||

| Pakistan | Indonesia | Pakistan | Indonesia | Pakistan | Indonesia | |

| Coal electricity | 82 | 19 | 17 | 7 | 10 | 6 |

| Electricity line | 77 | 5 | 22 | 5 | 13 | 4 |

| Transmission | 56 | 7 | 17 | 4 | 10 | 3 |

| Photovoltaic | 56 | 61 | 7 | 5 | 4 | 4 |

| Fire coal | 49 | 105 | 16 | 21 | 9 | 18 |

| Indonesia’s five most prominent utterances | Absolute quantity | Quantity of documents | Percentage of documents containing utterances | |||

| Indonesia | Pakistan | Indonesia | Pakistan | Indonesia | Pakistan | |

| Coal | 105 | 29 | 21 | 17 | 18 | 10 |

| Photovoltaic | 61 | 56 | 5 | 7 | 4 | 4 |

| New Energy | 46 | 21 | 27 | 11 | 23 | 7 |

| Fuel | 38 | 7 | 19 | 5 | 16 | 3 |

| Oil Price | 33 | 17 | 7 | 5 | 6 | 3 |

Source: author’s design.

Besides energy sources, a striking detail in the cross-country comparison of utterances is the diversity of actors raised in publications on Pakistan, which far exceed the number and type of actors referenced for Indonesia. Among the 118 actors mentioned in Pakistan, 17 are banks or funds, with the World Bank (N = 50), the International Monetary Fund (N = 46), and the Asia Development Bank (N = 42) leading the list of financial institutions. For Indonesia, MOFCOM documents list 14 credit providers among only 69 actors, with the World Bank (N = 43) again the most frequently cited institution. In terms of non-financial institutions, MOFCOM (N = 333) and the State Council (N = 168) are by far the most eminent actors in Pakistan and are topped only by the Regional Comprehensive Economic Partnership (RCEP) in Indonesia (N = 779). Table 2 lists the five most important contributors to energy construction in Pakistan and Indonesia. The table reflects the heightened specificity and level of detail provided in MOFCOM communications towards Pakistan’s energy sector, where a far greater number of individual projects and investors are mentioned than is the case for Indonesia. A fascinating finding is that none of the top five contributors in Pakistan are listed in documents directed at Indonesia, implying that a different set of actors is targeted for each country. Though state-owned conglomerates dominate in both countries, Pakistan overall receives more attention from private investors, with the ratio of state-owned to private enterprises extracted from MOFCOM communications reaching 5:1 in Pakistan and 7:1 in Indonesia.

Table 2. Top five Chinese energy companies by utterances in Pakistan and Indonesia

| Pakistan’s five most prominent Chinese energy investors by number of utterances | Absolute quantity | Quantity of documents | Percentage of documents containing utterances | ||||

| Pakistan | Indonesia | Pakistan | Indonesia | Pakistan | Indonesia | ||

| Power China | 23 | 0 | 11 | 0 | 7 | 0 | |

| Three Gorges | 19 | 0 | 6 | 0 | 4 | 0 | |

| State Grid | 13 | 0 | 11 | 0 | 7 | 0 | |

| Huawei | 9 | 0 | 5 | 0 | 3 | 0 | |

| China Energy Engineering | 6 | 0 | 1 | 0 | 0.6 | 0 | |

| Goldwind | 6 | 0 | 1 | 0 | 0.6 | 0 | |

| Indonesia’s five most prominent Chinese energy companies by number of utterances | Absolute quantity in | Quantity of documents | Percentage of documents containing utterances | ||||

| Indonesia | Pakistan | Indonesia | Pakistan | Indonesia | Pakistan | ||

| Gezhouba | 2 | 2 | 2 | 2 | 1.7 | 1.2 | |

| Harbin Electric | 1 | 0 | 1 | 0 | 0.8 | 0 | |

| China Coal Power | 1 | 0 | 1 | 0 | 0.8 | 0 | |

| Shenhua Energy | 1 | 0 | 1 | 0 | 0.8 | 0 | |

| Alibaba | 1 | 1 | 1 | 1 | 0.8 | 0.6 | |

Source: author’s design.

Instruments raised in MOFCOM publications constitute by far the largest and most heterogenous group of utterances. Of the 494 utterances, “cooperation” (N = 1,253 in Pakistan; N = 1,979 in Indonesia) was mentioned the most, followed by “One Belt One Road” (N = 656 in Pakistan; N =781 in Indonesia). Utterances that push actors in a certain direction, such as “to guide” (N = 312/77% in Pakistan; N = 180/53% in Indonesia), “to promote” (N = 255/37% in Pakistan; N = 376/54% in Indonesia), or “to support” (N = 213/42% in Pakistan; N = 335/63% in Indonesia), are also popular across the two countries. Expressions that bring businesses together are also promoted in MOFCOM communications, with “meetings” (N = 245/85%), “personal connections” (N = 224/35%), and “trade fairs” (N = 147/77%) regularly raised in Pakistan. “Personal connections” (N = 300/48%) and “meetings” (N = 246/75%) are also critical in Indonesia, but the order of frequency is reversed, and other terms connected to business gatherings, such as “investment cooperation” (N = 171/71%), are additional measures that MOFCOM promotes to expand Chinese investment in the country’s energy sector.

Instruments that encourage trade and investment are also frequently alluded to, with the “China-Pakistan Economic Corridor” (N = 139/27% of documents) in particular playing a crucial role in Central Asia. With respect to Pakistan, MOFCOM advises China to “open up to outward investment” (N = 138/8%) by “investing abroad” (N = 148/30%) via “FDI” (N = 176/18%) and “investment cooperation” (N = 171/79%), especially in “infrastructure projects” (N = 199/ 31%). “Foreign investment” (N = 298/43%), both in “infrastructure” (N = 351/44%) and “commerce” (N = 102/14%), is raised even more frequently in Indonesia. Because China lacks an Indonesian equivalent to its economic corridor with Pakistan, the range of geographical instruments is less prominent in MOFCOM communications towards South-East Asia. As a percentage of documents‚ “positive” and “negative” investment lists are raised more often in Indonesian (N = 110/35%; N = 57/32%) than they are in Pakistani directives (N = 97/22%; N = 16/19% respectively). Most strikingly, “privatisation” plays a dominant role in Pakistani-linked communication (N = 105/30%) but is almost absent from MOFCOM publications on Indonesia (N = 2/0.8%). The leading policy tools raised to achieve investment objectives in the two countries energy systems are “tariffs” (N = 258/32% for Indonesia; N = 155/22% for Pakistan) and “standards” (N = 143/28% for Indonesia; N = 121/21% for Pakistan). For both countries, Table 3 shows that, despite variations in rank order, utterances related to punishments, monetary policy, taxation, regulation, and loans play second fiddle to instruments concerning policy signalling, cross-border zones, investment promotion, or industrial policy formation.

Table 3. Rank order of utterance groups in MOFCOM communication on Pakistan and Indonesia’s energy systems

| Utterance group | Number of utterances in group | Total number of utterances Pakistan/Indonesia | Rank Pakistan | Rank Indonesia | |

| Signalling | 71 | 3,272 | 4,828 | 1 | 1 |

| Cross border zones | 46 | 1,715 | 1,595 | 2 | 3 |

| Investment | 62 | 1,461 | 1,792 | 3 | 2 |

| Industrial policy | 56 | 961 | 880 | 4 | 4 |

| Trade | 43 | 739 | 521 | 5 | 6 |

| Monitoring | 30 | 730 | 809 | 6 | 5 |

| Loans | 64 | 368 | 191 | 7 | 9 |

| Regulation | 51 | 328 | 411 | 8 | 7 |

| Taxation | 38 | 173 | 247 | 9 | 8 |

| Monetary policy | 19 | 50 | 63 | 10 | 10 |

| Punishment | 5 | 21 | 39 | 11 | 11 |

Source: author’s design.

Qualitative analysis of policy tools

To understand utterances’ purpose and context, a qualitative investigation of MOFCOM communications towards Pakistan and Indonesia’s energy sector was conducted. Utterances that seek to direct attention without providing active stimuli for investment include “state visits” (MOFCOM 2016a), the need for “cooperation” (MOFCOM 2015), “promises” made by “Xi Jinping” (MOFCOM 2017a), “meetings” (MOFCOM 2019a), or allusions to “environmental protection” (MOFCOM 2019b). The quantitative analysis identified “cooperation” as the single most used utterance in communications for both Pakistan and Indonesia. Yet, whereas in Pakistan MOFCOM connects promises of further “cooperation” to either President Xi’s visits to the country (MOFCOM 2015) or individual projects (MOFCOM 2017b), in Indonesia “cooperation” is more frequently deployed in conjunction with the RCEP (MOFCOM 2021a). Interestingly, “Xi Jinping” is mentioned in approximately the same share of documents in both countries, around 14%. Yet, in Pakistan, Xi is more frequently connected to promises of capital, for instance from the Silk Road Fund (MOFCOM 2017c), than in Indonesia, where visits to the country are primarily linked to the establishment of the “21st Century Maritime Silk Road” (MOFCOM 2014a), the RCEP (MOFCOM 2017d), and connected summits (MOFCOM 2019b).

Other key utterances are terms related to environmental protection, where an interesting temporal dynamic can be identified in MOFCOM’s communications. While publications directed at Pakistan contain an emphasis on “environmental protection” (MOFCOM 2019b), “green investment” (MOFCOM 2019c) in “renewables” (MOFCOM 2019d) and “sustainable development” (MOFCOM 2021c) prior to 2020, for Indonesia, these terms’ appearance accelerates only after 2021 (MOFCOM 2021b). A promise to transition away from coal, signed by 77 countries, including Indonesia, is highlighted in 2021 (MOFCOM 2021c), as well as the provision of “green funds” by the Asia Development Bank to help the country navigate its energy transition (MOFCOM 2021d). Yet, while a host of projects, both renewable (MOFCOM 2019d) and fossil-fuelled (MOFCOM 2017b), are addressed in MOFCOM publications on Pakistan, only one solar project (MOFCOM 2021e) is raised in statements directed at Indonesia. This lack in specificity towards Indonesia is also reflected in the only six Indonesian companies addressed (MOFCOM 2021f); a much lower number compared to 17 Pakistani counterparts (MOFCOM 2020a). MOFCOM’s public communications also suggest that Pakistan receives more attention from China’s two policy banks (MOFCOM 2017c) and the Silk Road Fund (MOFCOM 2017e), though mostly prior to 2018, when Chinese policy efforts to green investments abroad intensified (MOFCOM 2019c).

Delving into other high-ranked utterances shows how MOFCOM’s language towards Pakistan has been less restrictive and more encouraging than statements on Indonesia. Special attention is paid to single, predominantly coal-fired projects in Pakistan’s Balochi (MOFCOM 2019e) and Southern Tar regions (MOFCOM 2022), nuclear plants in Karachi (MOFCOM 2019b), as well as renewable projects in Sindh (MOFCOM 2019f). In Indonesia, meanwhile, communications show that Chinese companies have established (at least) ten “trade cooperation zones” (MOFCOM 2021f), though to what extent these zones are connected to energy could not be gleaned. Terms on investment, such as “infrastructure investment” and “FDI,” are similar in frequency for both countries, but diverge slightly in context. Whereas for Indonesia, MOFCOM calls for Chinese investment in a host of industries, including energy (MOFCOM 2014b), messaging is more directed to types of energy in Pakistan (MOFCOM 2019c). With reference to the two primary industrial policy tools, tariffs and standards, MOFCOM’s communications indicate that Chinese investors can benefit from energy tariffs (MOFCOM 2021g), export promotion, and other incentives to relieve Pakistan from expensive fossil imports (MOFCOM 2020b). Statements that raise similarly incentivising offers were not found for Indonesia’s energy system, where the emphasis is rather on removing tariffs on fossil fuels than promoting renewables (MOFCOM 2016b).

Discussion

On the basis of the preceding quantitative and qualitative analyses, the discussion evaluates instruments’ level of intrusiveness, which is in turn connected to Lowi’s (1985) typology of public policies and steering modes. For Pakistan, quantitative findings uncovered “cooperation” as the most frequently referenced utterance, followed by “One Belt One Road” and other signalling devices. The qualitative analysis then revealed that signalling devices are either connected with President Xi’s visits (MOFCOM 2016a) or single energy projects (MOFCOM 2022). This connection raises Pakistan’s status as an investment destination, generates urgency, and provides concrete examples of Chinese ventures. The combination of utterances emphasises opportunities in Pakistan’s energy sector without mandating individual companies to invest. The great range of actors offers further evidence of the more open and incentivising nature of MOFCOM communications. In raising awareness of opportunities without enforcing control, MOFCOM creates a framework for objects to select spheres of investment in Pakistani electricity generation. By establishing rules about rules (Lowi 1985), objects are encouraged, but also granted authority to select channels of investment within an established cooperation framework: the China-Pakistan Economic Corridor. Consequently, redistributive and constituent public policies connected to indirect and soft modes of steering are most apt to describe MOFCOM’s steering of Chinese energy investment in Pakistan.

In Indonesia, China has not (yet) established a BRI framework corresponding to its economic corridor with Pakistan. Instead, MOFCOM communications on energy investments mostly address Indonesia as one of many countries in the RCEP. This impression is underlined by quantitative findings for Indonesia that rank “cooperation” with the “RCEP” as the two most frequently referenced utterances. “To guide,” “promote,” and “support” are also prevalent, as are tools that bring investors together, such as “meetings” and “trade fairs.” Yet, the heightened emphasis on “tariffs” and “standards,” as well as “positive” and “negative lists” in Indonesia compared to Pakistan, indicates that freedom to invest is restricted to a greater degree in the former than in the latter country. The lack of concrete investment examples further moderates MOFCOM’s encouragement to invest in Indonesia’s energy sector. The far lower number of actors, as well as the relative dominance of SOEs over private enterprises, reflects MOFCOM’s sense of restraint. While not prescriptive or controlling in the sense of regulatory edicts, MOFCOM publications also do not incentivise to the degree demanded by redistributive public policies. Neither does the resulting dominance of SOEs suggest a desire to raise competition among a greater range of objects. So, while MOFCOM communications do not explicitly pick winners, dominant utterances do result in a more confined investment environment, serving as a light version of regulatory policies on the border towards redistributive measures that impose positions, but do not command or control as demanded by the hardest modes of steering.

In sum, objects investing in Pakistan and Indonesia’s energy sectors are subjected to divergent types of public policies that in turn connect to modes of steering along a hard-soft continuum. In Pakistan, softer modes result in a more open, encouraging, and incentivising investment environment that allows objects to tap a wider variety of investment tools and energy sectors. The China-Pakistan Economic Corridor gives the institutional framework that offers security and opens participation to a broader set of objects. The frequent documentation of “meetings” about specific energy projects (MOFCOM 2019a) shows how subjects are mindful of inviting input in policy design. Consequently, the resulting set of statements can be located towards the softer end of the hard-soft steering continuum. This article argues that these softer modes contribute to a more heterogenous mix of energy investments in Pakistan compared to Indonesia, where harder modes are deployed. Specifically, MOFCOM’s statements on Indonesia are less enabling, both in the sense of instrument selection and object participation. The quantitative and qualitative analyses support findings from secondary literature (Liu, Hale, and Urpelainen 2023) arguing that the space for private investors to engage in Indonesia’s energy sector is constrained by subjects’ attention on SOEs. While MOFCOM communications cannot be described as controlling or regulatory in the hardest sense, utterances also do not incentivise competition or allow objects to select tools themselves. A mode between hard and indirect steering therefore best describes MOFCOM’s public policy statements on Indonesia’s energy sector. This mode of steering contributes to investments from a narrow source of capital, carried out by a limited number of investors and primarily directed at one energy source: coal.

Conclusion

Building on an extensive quantitative and qualitative analysis of MOFCOM’s public policy statements, this article has shown how steering theory can be deployed to explain divergences in investment streams towards BRI countries’ energy systems. The premise, that MOFCOM (and other subjects’) communications incentivise or restrict investors in their decisions to allocate capital, was born out by links established between the number and variety of actors involved in Pakistani energy ventures and the limited scope of players (particularly private investors) in Indonesian electricity generation. Following SKAD’s methodological guidance, recurring utterances on the instruments selected for stimulating investment were extracted from a set of documents harvested from MOFCOM’s website. After coding and categorisation, utterances were interpreted against Lowi’s typology for public policies, which in turn links to modes of steering along a hard-soft continuum. In doing so, the study shows that softer modes of steering enable objects to select from a wider range of investment channels and energy sectors in Pakistan, whereas in Indonesia, MOFCOM’s deployment of harder modes of steering contributed to more homogenous investment patterns dominated by a small set of SOEs investing in a single energy source.

Following similarly compelling factors that help explain divergent investment patterns in energy sectors along the Belt and Road, the addition of steering theory offers a wide array of possible future paths of inquiry. Specifically, steering theory opens up the possibility of examining how subject-object relations, coalition building, and negotiation under the shadow of hierarchy can affect the provision and direction of Chinese capital in BRI countries’ energy sectors. Additionally, comparative studies that investigate other subjects’ (e.g., policy banks’) selection of modes and instruments to steer investments along the BRI could prove illustrative. Since document analysis alone is insufficient to establish causal mechanisms between subjects’ interventions and objects’ response, qualitative interviews with policymakers and industrial actors in China, Pakistan, and Indonesia could shed light on the effectiveness of subjects’ (including MOFCOM’s) steering capacity. In this way, steering theory can contribute to understanding Chinese subject’s strategy formulation, policy choices, and priority setting, as well as objects’ response in shaping necessary energy transitions in countries along the Belt and Road.

Acknowledgements

I gratefully acknowledge the financial support of the University of Würzburg’s China Competence Centre for helping me conduct this research. My express gratitude for helping me revise the manuscript go to the team at the Chair of China Business and Economics at the University of Würzburg, as well as the two anonymous reviewers, whose invaluable input significantly improved the paper. Any remaining errors are my own.

Manuscript received on 14 August 2023. Accepted on 11 June 2024.

Primary sources

GALLAGHER, Kevin P. 2021a. “China’s Global Energy Finance Database.” Global Development Policy Centre. https://www.bu.edu/cgef/#/all/Country (accessed on 26 January 2023).

——. 2021b. “China’s Global Power Database.” Global Development Policy Centre. https://www.bu.edu/cgp/ (accessed on 26 January 2023).

MOFCOM 中華人民共和國商務部. 2014a. “新絲綢之路: 從戰略構想到現實規則” (Xin sitiao zhi lu: Cong zanlüe gouxiang dao xianshi guize, New Silk Road: From strategic thought to realising rules). http://chinawto.mofcom.gov.cn/article/br/bs/201504/20150400958859.shtml (accessed on 11 June 2023).

——. 2014b. “第2屆南博會暨第22屆昆交會外經貿簽約成交210.3億美元” (Di 2 jie nanbohui ji di 22 jie kunjiaohui waijingmao jianyue chengjiao 210.3 yi meiyuan, The second South Asia Exposition and the 22nd Kunming Import & Export Fair sign a deal worth USD 21.03 billion). http://kmtb.mofcom.gov.cn/article/shangwxw/201406/20140600622516.shtml (accessed on 11 June 2023).

——. 2015. “關於一帶一路背景下促進中巴產業合作的分析與建議” (Guanyu yi dai yi lu beijing xia cujin Zhong Ba chanye hezuo de fenxi yu jianyi, Analysis and suggestions on advancing China-Pakistan industrial cooperation in the background of the One Belt One Road). http://karachi.mofcom.gov.cn/article/ztdy/201603/20160301275909.shtml (accessed on 11 June 2023).

——. 2016a. “巴基斯坦經商參處參會資料” (Bajisitan jingshang canchu canhui ziliao, Pakistan business and trade commission conference material). http://hk.mofcom.gov.cn/article/o/201811/20181102812052.shtml (accessed on 12 June 2023).

——. 2016b. “經合組織: 印尼需加強稅收改⾰, 改善公共⽀出和公共治理” (Jinghe zuzhi: Yinni xu jiaqiang shuigai gaige, gaishang gonggong zhichu he gonggong zhili, OECD: Indonesia needs to strengthen tax reform, improve public spending and governance). http://be.mofcom.gov.cn/article/jmxw/201610/20161001497896.shtml (accessed on 11 June 2023).

——. 2017a. “各國元⾸, 國際組織負責⼈積極評價一帶一路倡議” (Ge guo yuanshou, guoji zuzhi fuzeren jiji pingjia yi dai yi lu changyi, Country and international organisation leaders positively evaluate One Belt and Road). http://ir.mofcom.gov.cn/article/jmxw/201705/20170502577574.shtml (accessed on 12 June 2023).

——. 2017b. “勇做一帶一路建設排頭兵” (Yongzuo yi dai yi lu jianshe paitoubing, Bravely be frontrunners in constructing the One Belt One Road). http://chinawto.mofcom.gov.cn/article/br/bs/201708/20170802625446.shtml (accessed on 11 June 2023).

——. 2017c. “中國與一帶一路沿線國家⾦融合作的機遇與挑戰” (Zhongguo yu yi dai yi lu yanxian guojia jinrong hezuo de jiyu yu tiaozhan, Opportunities and challenges for financial cooperation between China and countries along the Belt and Road). https://beltandroad.hktdc.com/sc/insights/zhongguoyuyidaiyiluyanxianguojiajinronghezuodejiyuyutiaozhan (accessed on 11 June 2023).

——. 2017d. “商務部召開例行新聞發佈會(2017年9月14日)” (Shangwubu zhaokai liexing xinwen fabuhui (2017 nian 9 yue 14 ri), The Ministry of Commerce press conference on 14 September 2017). http://www.mofcom.gov.cn/article/ae/ah/diaocd/201709/20170902643827.shtml (accessed on 11 June 2023).

——. 2017e. “沈行芬: 國際範中國風” (Shen Xingfen: Guojifan Zhongguo feng, Shen Xingfen: International regulation on Chinese wind). http://lgj.mofcom.gov.cn/article/zzsh/201706/20170602590532.shtml (accessed on 11 June 2023).

——. 2019a. “一帶一路能源合作夥伴關係成立” (Yi dai yi lu nengyuan hezuo huoban guanxi chengli, On establishing One Belt One Road energy partnerships). http://kz.mofcom.gov.cn/article/jmxw/201905/20190502859481.shtml (accessed on 11 June 2023).

——. 2019b. “一帶一路論壇圓桌峰會聯合公報” (Yi dai yi lu luntan yuanzhuo fenghui lianhe gongbao, Report on the Belt and Road forum roundtable summit). http://www.mofcom.gov.cn/article/i/jyjl/e/201904/20190402858198.shtml (accessed on 11 June 2023).

——. 2019c. “全球30家⾦融機構簽署綠色投資原則” (Quanqiu 30 jia jinrong jigou qianshu lüse touzi yuanze, 30 global finance institutions sign the green investment principles). http://kz.mofcom.gov.cn/article/jmxw/201908/20190802892384.shtml (accessed on 11 June 2023).

——. 2019d. “巴政府計畫大幅提升電力供應能力” (Ba zhengfu jihua dafu tisheng dianli gongying nengli, Pakistani government plans to substantially increase electricity provision). http://pk.mofcom.gov.cn/article/jmxw/201909/20190902897952.shtml (accessed on 11 June 2023).

——. 2019e. “巴基斯坦總理出席中電胡布電站投入商業運行慶典儀式” (Bajisitan zongli chuxi zhongdian hubu dianzhan touru shangye yunxing qingdian yishi, Pakistan Premier chairs China Power and Hubco commercial operations ceremony). http://karachi.mofcom.gov.cn/article/zgdt/201910/20191002908407.shtml (accessed on 11 June 2023).

——. 2019f. “信德省首次對太陽能電站項⽬進行競價招標” (Xindesheng shouci dui taiyangneng dianzhan xiangmu jinxing jingjia zhaobiao, Sindh Province first solar power station starts competitive tendering). http://karachi.mofcom.gov.cn/article/jmxw/201912/20191202920616.shtml (accessed on 11 June 2023).

——. 2020a. “巴基斯坦國家電力監管局對卡拉奇電力公司處以2億盧比罰款” (Bajisitan guojia dianli jianguanju dui Kalaqi dianli gongsi chuyi 2 yi lubi fakuan, Pakistan’s electricity regulator fines Karachi Electricity Company 200 million rupees). http://karachi.mofcom.gov.cn/article/jmxw/202009/20200902997735.shtml (accessed on 11 June 2023).

——. 2020b. “巴基斯坦政府批准對5個出個出口行業提供230億盧比補貼” (Baijisitan zhengfu pizhun dui 5 ge chukou hangye tigong 230 yi lubi butie, Pakistani government approves 23-billion-rupee subsidies for five export industries). http://karachi.mofcom.gov.cn/article/jmxw/202003/20200302944845.shtml (accessed on 11 June 2023).

——. 2021a. “區域全⾯經濟夥伴關係協定成員國國際貿易數字展開幕” (Quyu quanmian jingji huoban guanxi xieding chengyuanguo guoji maoyi shuzi zhankaimu, Raising the curtain on the RCEP’s international digitalisation conference). http://chinawto.mofcom.gov.cn/article/e/s/202107/20210703181395.shtml (accessed on 11 June 2023).

——. 2021b. “一帶一路綠色發展夥伴關係倡議” (Yi dai yi lu lüse fazhan huoban guanxi changyi, Proposal for One Belt One Road green development partnerships). http://kz.mofcom.gov.cn/article/jmxw/202106/20210603161709.shtml (accessed on 11 June 2023).

——. 2021c. “77國簽署聲明承諾逐步淘汰燃煤發電” (77 guo qianshu shengming chengnuo zhubu taotai ranmei fadian, 77 countries sign an agreement promising to transition away from coal generation). http://ie.mofcom.gov.cn/article/jmxw/202112/20211203223360.shtml (accessed on 11 June 2023).

——. 2021d. “亞開行將成立基金幫助東南亞脫碳” (Yakaihang jiang chengli jijin bangzhu Dongnanya tuomei, The Asia Development Bank will establish a fund to help South-East Asian countries transition from coal). http://asean.mofcom.gov.cn/article/jmxw/202111/20211103214804.shtml (accessed on 11 June 2023).

——. 2021e. “東盟擬於2022年試點區域電網互聯傳輸綠色電力” (Dongmeng niyu 2022 nian shidian quyu dianwang hulian chuanshu lüse dianli, ASEAN draw up 2022 demonstration project for interconnected green transmission of electricity). http://asean.mofcom.gov.cn/article/jmxw/202110/20211003213162.shtml (accessed on 11 June 2023).

——. 2021f. “善用境外經貿合作區,開拓一帶一路新商機: 香港工商界走進‘四國五園’線上交流會第二場活動成功舉辦” (Shanyong jingwai jingmao hezuoqu, kaituo yi dai yi lu xinshang ji: Xianggang gongshangjie zoujin “si guo wu yuan” xianshang jiaoliuhui di er chang huodong chenggong juban, Optimise the use of trade cooperation zones abroad, open new commercial opportunities along the Belt and Road: Hong Kong’s business circle “four countries, five gardens” online exchange is held successfully). http://hk.mofcom.gov.cn/article/jmxw/a/202112/20211203227625.shtml (accessed on 11 June 2023).

——. 2021g. “巴政府為達蘇水電站專案擴建向世界銀行申請7億美元貸款” (Ba zhengfu wei dalao shuidianzhan xiangmu kuojian xiang shijie yinhang shenqing 7 yi meiyuan daikuan, Pakistani government increases World Bank application for 700 million US dollar loan for Dasu Hydro Power Plant). http://karachi.mofcom.gov.cn/article/jmxw/202002/20200202938844.shtml (accessed on 11 June 2023).

——. 2022. “駐卡拉奇總領事李碧建會见信德省能源部长” (Zhu Kalaqi zongling Shi Libi jianhui jian Xindesheng nengyuan buzhang, Chinese Ambassador to Karachi Li Bijian will Visit Sindh Province’s Energy Department Chief). http://karachi.mofcom.gov.cn/article/zgdt/202206/20220603319852.shtml (accessed on 11 June 2023).

References

ANDERSON, John. 1997. “Governmental Suasion: Refocusing the Lowi Policy Typology.” Policy Studies Journal 25(2): 266-82.

BÖRZEL, Tanja A., and Thomas RISSE. 2010. “Governance without a State: Can it Work?” Regulation & Governance 4(2): 113-34.

CLARKE, Michael. 2017. “The Belt and Road Initiative: China’s New Grand Strategy?” Asia Policy 24: 71-9.

CORBIN, Juliet, and Anselm STRAUSS. 2008. Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory. Thousand Oaks: Sage.

EASTON, David. 1965. A Framework for Political Analysis. Englewood Cliffs: Prentice-Hall Inc.

FISCHER, Doris, Hannes GOHLI, and Sabrina Habich-Sobiegalla. 2021. “Balancing Stability and Development: Industrial Policies under Xi Jinping.” Issues and Studies 57(4). https://doi.org/10.1142/S1013251121500168

FOUCAULT, Michel. 1974. Von der Subversion des Wissens (On the subversion of knowledge). München: Fischer.

HARIS, Muhammad, Qing YANG, and Yingxin BI. 2022. “Relying on Coal: The Drivers of Coal in the Energy Mix of Pakistan.” Proceedings of the 2021 5th International Conference on E-business and Internet: 119-23.

HECKATHORN, Douglas D., and Steven M. MASER. 1990. “The Contractual Architecture of Public Policy: A Critical Reconstruction of Lowi’s Typology.” The Journal of Politics 52(4): 1101-23.

KELLER, Reiner. 2007. Diskursforschung: Eine Einführung für SozialwissenschaftlerInnen (Discourse research: An introduction for social scientists). Wiesbaden: VS Verlag für Sozialwissenschaften.

KONG, Bo and Kevin P. GALLAGHER. 2019. “Globalization as Domestic Adjustment: Chinese Development Finance and the Globalization of China’s Coal Industry.” Global China Initiative 4. https://www.bu.edu/gdp/files/2019/04/GCI-GDP.WP6-Globalization-as-Domestic-Adjustment-Kong-Gallagher.pdf (accessed on 14 June 2024).

LI, Zhongshu, Kevin P. GALLAGHER, and Denise L. MAUZERALL. 2020. “China’s Global Power: Estimating Chinese Foreign Direct Investment in the Electric Power Sector.” Energy Policy 136. https://doi.org/10.1016/j.enpol.2019.111056

LIN, Baoqiang, and François BEGA. 2021. “China’s Belt & Road Initiative Coal Power Cooperation: Transitioning toward Low-carbon Development.” Energy Policy 156. https://doi.org/10.1016/j.enpol.2021.112438

LIU, Chuyu, Thomas HALE, and Johannes Urpelainen. 2023. “Explaining the Energy Mix in China’s Electricity Projects under the Belt and Road Initiative.” Environmental Politics 32(7): 1117-39.

LOWI, Theodore. 1985. “The State in Politics: The Relation between Policy and Administration.” In Roger NOLL (ed.), Regulatory Politics and the Social Sciences. Berkeley: University of California Press. 67-90.

LUHMANN, Niklas. 1987. Soziale Systeme (Social systems). Frankfurt am Main: Suhrkamp.

MA, Xinyue. 2020. “Understanding China’s Global Power.” Global China Initiative 10. https://www.bu.edu/gdp/files/2020/10/GCI_PB_000_EN-2.pdf (accessed on 14 June 2024).

MAÇÃES, Bruno. 2019. Belt and Road: A Chinese World Order. London: Hurst.

MAYNTZ, Renate. 1987. “Politische Steuerung und Gesellschaftliche Steuerungsprobleme” (Political control and social control problems). In Thomas ELLWEIN, Joachim Jens HESSE, Renate MAYNTZ, and Fritz W. SCHARPF (eds.), Jahrbuch zur Staats- und Verwaltungswissenschaft: Band 1/1987 (Yearbook on the science of state and administration, vol. 1, 1987). Baden-Baden: Nomos. 89-110.

MAYNTZ, Renate. 1990. “Politische Steuerbarkeit und Reformblockaden” (Political steering and barriers to reform). In Renate MAYNTZ (ed.), Soziale Dynamik und politische Steuerung. Theoretische und Methodologische Überlegungen (Social dynamics and political steering. Theoretical and methodological thoughts). Frankfurt am Main: Campus. 209-38.

MURPHY, Elizabeth. 1997. “Constructivism: From Philosophy to Practice.” https://files.eric.ed.gov/fulltext/ED444966.pdf (accessed on 14 June 2024).

SCHARPF, Fritz W. 2000. Interaktionsformen. Akteurzentrierter Institutionalismus in der Politikforschung (Forms of interaction: Actor-centred institutionalism in political sciences). Opladen: Leske + Budrich.

SCHNEIDER, Florian. 2021. Global Perspectives on China’s Belt and Road Initiative. Amsterdam: Amsterdam University Press.

SCHUBERT, Gunter, and Björn ALPERMANN. 2019. “Studying the Chinese Policy Process in the Era of ‘Top-level Design’: The Contribution of ‘Political Steering’ Theory.” Journal of Chinese Political Science 24(2): 199-224.

SCHULHOF, Vera, Detlef van VUUREN, and Julian Kirchherr. 2022. “The Belt and Road Initiative (BRI): What Will it Look Like in the Future?” Technological Forecasting and Social Change 175. https://doi.org/10.1016/j.techfore.2021.121306

SCHÜNEMANN, Wolf J. 2018. “SKAD Analysis of European Multi-level Political Debates.” In Reiner KELLER, Anna-Katharina HORNIDGE, and Wolf J. SCHÜNEMANN (eds.), The Sociology of Knowledge Approach to Discourse: Investigating the Politics of Knowledge and Meaning-making. London: Routledge. 179-215.

SHEN, Wei, and Marcus POWER. 2017. “Africa and the Export of China’s Clean Energy Revolution.” Third World Quarterly 38(3): 678-97.

TRITTO, Angela. 2021. “China’s Belt and Road Initiative: From Perceptions to Realities in Indonesia’s Coal Power Sector.” Energy Strategy Reviews 34. https://doi.org/10.1016/j.esr.2021.100624

WILLKE, Helmut. 2014. Regieren (Governance). Wiesbaden: Springer VS.

ZENG, Jinghan. 2019. “Narrating China’s Belt and Road Initiative.” Global Policy 10(2): 207-16.

ZHAO, Yabo, Xiaofeng LIU, Shaojian WANG, and Yujing GE. 2019. “Energy Relations between China and the Countries along the Belt and Road: An Analysis of the Distribution of Energy Resources and Interdependence Relationships.” Renewable and Sustainable Energy Reviews 107: 133-44.

ZHOU, Lihuan, Sean GILBERT, Ye WANG, Miquel Muñoz CABRÉ, and Kevin P. GALLAGHER. 2018. “Moving the Green Belt and Road Initiative: From Words to Actions.” World Resources Institute Working Paper. https://www.wri.org/research/moving-green-belt-and-road-initiative-words-actions (accessed 26 January 2023).

[1] The Commissioner’s Office of China’s Foreign Ministry in the Hong Kong SAR, 2013, “Promote Friendship Between Our People and Work Together to Build a Bright Future,” http://hk.ocmfa.gov.cn/eng/jbwzlm/xwdt/wsyw/201309/t20130918_7781702.htm (accessed on 26 January 2023).

[2] National Development and Reform Commission, Ministry of Foreign Affairs, and Ministry of Commerce of the People’s Republic of China, “Vision and Actions on Jointly Building the Silk Road Economic Belt and the Twenty-first century Maritime Silk Road,” March 2015, Belt and Road Initiative. Hong Kong, https://www.beltandroad.gov.hk/visionandactions.html (accessed on 14 June 2024).

[3] Christoph Nedopil Wang, 2022, “China Belt and Road Initiative Investment Report 2021,” Green Finance and Development Center Working Report. http://obela.org/system/files/Nedopil-2022_BRI-Investment-Report-2021_0.pdf (accessed on 26 January 2023).

[4] Ma Ziyi, 2022, “China Committed to Phase Out Overseas Coal Investment: New Database Tracks Progress,” World Resources Institute, https://www.wri.org/insights/china-phasing-out-overseas-coal-investment-track-progress (accessed on 26 January 2023).

[5] The study follows Lowi’s definition of public policy as “statements attempting to set forth the purpose, the means, the subjects and the objects of coercion.” These statements, issued by governmental authorities, “express an intention to influence the behaviour of citizens, individually or collectively, by use of positive or negative sanctions” (Lowi 1985: 70).

[6] To clarify, the point is not to suggest mutual exclusivity in mode-policy pairings. In reality, subjects may pair any mode of steering with any type of public policy. Rather, the argument is that Lowi’s (1985) descriptions of different types of public policies correspond closest with certain modes of steering from along the continuum (Schubert and Alpermann 2019).

[7] Consequently, the article does not claim that MOFCOM enjoys exclusive ownership over instruments identified in the findings. Given the importance of the BRI to Chinese foreign policy, it is highly likely that multiple steering subjects (such as the NDRC and MFA) contribute to mode and instrument selection. As highlighted in the study’s limitations, the extent to which different subjects contribute to policy formulation requires more in-depth investigation that goes beyond the scope of this research.

[8] Documents were excluded when: Pakistan or Indonesia were listed along with other countries, when China was not directly involved, in case of duplicates, or when the initial search produced a document containing selected key words but was not connected to energy directly (e.g., the steel industry in Pakistan or palm oil in Indonesia). For the full list of documents, please contact the author.

[9] The terms in the first column of Tables 1 and 2 show the utterances that were first identified and then inserted as key words in Pakistan’s 164 and Indonesia’s 117 documents.