BOOK REVIEWS

Different Privileges, Divergent Paths: Income Loss Among Administrative Elites and Market Elites in China During Covid-19

Qingyi Zhao is a PhD candidate in the Department of Sociology, School of Social Sciences, Tsinghua University, Room 123, Mingzhai Building, Haidian District, Beijing 100084, China (lanyiqingyi1999@qq.com).

Haijun Shi (corresponding author) is a PhD candidate in the Department of Sociology, School of Social Sciences, Tsinghua University, Xiong Zhixing Building, Haidian District, Beijing 100084, China (shihaijun6324@gmail.com).

Introduction

As one of the most devastating pandemics in human history, Covid-19 has claimed the lives of more than 7 million people worldwide since its first outbreak.[1] The impact of the pandemic nevertheless extended far beyond the realm of public health. Research has shown that Covid-19 brought about various social consequences, including macroeconomic decline, increased unemployment, exacerbated racism, and divergence in satisfaction with the government (Brodeur et al. 2021; Elias et al. 2021; Wu et al. 2021).

At the individual level, one of the most significant socioeconomic impacts of Covid-19 is loss of income. Research conducted in various corners of the world has yielded consistent findings: overall, people’s incomes have suffered loss during the Covid-19 pandemic, but those with lower socioeconomic status suffered more (Almeida et al. 2021; Brewer and Tasseva 2021; Kansiime et al. 2021). Similar Matthew effect[2] was also found in China. Scholars have shown that Chinese individuals in more advantageous socioeconomic positions experienced smaller losses during the pandemic (Qian and Fan 2020; Zhang et al. 2022). Moreover, Covid-19 introduced a risk of falling back into poverty for Chinese workers, especially migrant workers (Ranjan 2021).

However, little attention has been paid to the disparities in income loss among socio-economically advantaged groups, i.e., the elites, in China during Covid-19. We argue that it is a topic of particular significance, for elites in China are highly heterogeneous in terms of their sources of advantage, which, more importantly, reflects the tension between the redistribution system and the market system in contemporary China.

The term “elite” refers to social groups that occupy dominant positions in a specific social structure (Li, Qin, and Chen 2012). Since the power of elites emanates from the dominance structure within their society, the categorisation of elites in a society should be based on its dominance structure. A widely accepted theory regarding the categorisation of elites in China is proposed by Liu (2018, 2021), who bases elite typology on the property rights system and its relationship with state power, proposing a classification of elites and explaining the differences in the mechanisms through which different elites attain their status.

In today’s China, there are two major types of property rights: one is public ownership prevailing in the public sector, where the redistribution system holds sway, and the other is private ownership prevailing in the private sector, where the market system predominates. Liu further points out that in the public sector, the major dominance structure is based on the authority of the redistribution system; people who occupy mid- to high-level positions within this dominance structure are then referred to as administrative elites.[3] In the private sector, the main dominance structure is based on contracts voluntarily agreed upon under the rules of the market system; people who occupy mid- to high-level positions within this dominance structure are then referred to as market elites. Administrative elites mainly consist of individuals engaged in managerial roles or holding administrative-level positions within Party and government agencies, public institutions, and state-owned enterprises (SOEs), while market elites primarily refer to private business owners as well as higher-ranking managers and professionals in the private sector.

From a historical perspective, in the planned economy era of China, all elites were administrative elites, for the dominance structure in Chinese society then revolved solely around the public sector and the redistribution system. Market elites only started to appear in China after the introduction of the market economy (Nee 1989). Many studies have pointed out that the tension between the redistribution system and the market system is one of the central conflicts throughout China’s transition process (Walder 2003; Walder and He 2014). Since administrative elites and market elites hold top positions in the two systems, respectively, the disparities between these two groups reflect tensions between the redistribution system and the market system, making it a crucial issue in China studies.

Returning to the scenario of Covid-19, unlike many other countries, for almost three years during the Covid-19 pandemic, China adhered to policies of “dynamic zero-Covid” characterised by strictly implemented lockdowns and quarantine measures, mass testing, and other hard restrictive measures (Burki 2022; Ioannidis, Zonta, and Levitt 2023). The execution of these strict measures protected the lives and health of Chinese people but simultaneously constrained the production, logistics, and trade of companies, which in turn obstructed the functioning of the market system. Under such circumstances, a secure, guaranteed income stream would become the only effective means of preventing income loss, which is precisely what was provided by the increasingly strengthened redistribution system during the pandemic and was enjoyed by the administrative elites. Consequently, the two types of elites may have experienced vastly different degrees of income loss during Covid-19.

Against this background, this study seeks to address the following questions: With the advent of the Covid-19 pandemic, how have the degrees of income loss for market and administrative elites differed? What factors could explain the mechanism behind their divergent paths? We will use data from the 2021 wave of the Chinese General Social Survey and employ various econometrics models to investigate these questions. This study is not only a forerunner in unravelling disparities in income loss among China’s elites during Covid-19, but also reveals changes in power between the redistribution system and the market system, as well as between the public sector and private sector in China during the pandemic.

Theoretical framework and hypotheses

As mentioned above, this study aims to explore differences in the income losses of the two types of elites in China during the Covid-19 pandemic. This primarily involves understanding the different capacities of administrative elites and market elites to safeguard their incomes from adverse effects (Standing 1995), which can be termed their resilience to income risks or the security of their income.

Generally speaking, both administrative and market elites, by virtue of their elite status, typically enjoy higher incomes compared to the non-elite group when both the redistribution system and the market system operate normally (Bian and Zhang 2002; Chen and Tian 2007). They experienced noticeable income improvements throughout the process of economic reform relative to other groups in Chinese society, with market elites benefitting even more (Li 2019). At the same time, for both administrative and market elites, their prestigious social status and abundant capital have endowed them with a greater capacity to cope with the daily fluctuations in the market and society. However, as mentioned in the introduction, the advantages of administrative and market elites originate from entirely different systems. Therefore, their risk resilience in income stems from different institutional logics.

For administrative elites, their income security emanates from the stable salary provided by the redistribution system, which allows them to “weather the storm” as long as the system itself remains stable (Liu and Ma 2016). Fundamentally, the source of resilience to income risks for administrative elites lies in the fact that the powerful redistribution system can continuously extract resources and allocate them to its elite members despite various external shocks, including fluctuations in the economy or epidemics/pandemics such as Covid-19. As long as the redistribution system remains in place, which is the case in China, administrative elites will consistently maintain a high level of resilience to income risks.

On the other hand, the source of income security for market elites is vastly different. While an individual market elite sometimes experiences considerable income loss (Tan and Li 2018), the average income of market elites has never experienced an overall decline since the onset of marketisation (Ci, Liu, and Han 2021). Even under the global financial crisis in 2008, market elites in China as a whole continued to make a profit (Ju, Lu, and Yu 2013). This suggests that, under normal circumstances, market elites as a group possess considerable resilience to income risks.

We argue that the sources of resilience to income risks of the market elites can be summarised into two factors. First, market elites generally possess entrepreneurial skills. They tend to have strong innovative abilities, and are good at identifying and seizing market opportunities (Amsden, DiCaprio, and Robinson 2012). Consequently, when faced with market fluctuations, market elites are adept at finding new growth points (Solimano and Avanzini 2012). Additionally, when facing difficulties, market elites are often prone to find alternative solutions and navigate challenges through various innovative means. Therefore, even amidst market volatility, market elites still have advantages in terms of resilience to income risks compared with other groups.

Second, due to their typically high income under normal circumstances, market elites tend to accumulate various types of assets over time, including real estate and financial securities for example (Standing 2008). These assets can all generate income for their owners. In effect, research has shown that the share of labour income in the total income of market elites is decreasing; instead, their income is increasingly dependent on capital gains and investment returns (Nau 2013). Therefore, even when market conditions are unfavourable, and their labour income or business performance suffers, market elites can rely on their income from investments, such as rent, interest, and dividends, to maintain their total income without significant decline.

However, the effectiveness of these two sources of income security for market elites depends on a well-functioning and relatively prosperous market system. On the one hand, the overall prosperity of the market ensures a long-term trend of economic growth. Only in the context of sustained economic growth can various industries and capital markets remain prosperous, enabling market elites to earn high incomes either through their exceptional performance in their respective industries or through capital gains. On the other hand, in a well-functioning market, although there are periodic market fluctuations, their magnitude is generally not too significant, and it is unlikely that all industries will experience simultaneous fluctuations in the same direction. In other words, when some industries are underperforming, other industries will often be thriving. This provides market elites with the opportunity to apply their entrepreneurial skills and innovative capabilities to seek opportunities in other industries when their own industry is struggling.

Since the 1990s, China maintained economic growth rates of over 6% for many years, a remarkable feat in world economic history. Despite occasional market fluctuations, the period from market reform to the onset of the Covid-19 pandemic witnessed mostly small-scale and cyclical market volatility. In most cases, different industries did not simultaneously experience upswings or downturns but rather exhibited substantial differentiation (Gan, Zheng, and Yu 2011). Therefore, before the outbreak of the Covid-19 pandemic, even though individual market elites sometimes experienced ups and downs, the market conditions in China supported the market elites, as a whole, in maintaining their income security.

However, during the Covid-19 pandemic, the prerequisite for maintaining the income security of market elites – namely, a prosperous and well-functioning market system – no longer existed. First, China’s economic growth decelerated substantially during Covid-19: GDP growth rate dropped from 6% in 2019 to 2.2% in 2020, the lowest since 1978. Second, due to the pathogenicity of the Covid-19 virus itself and China’s stringent pandemic control measures, the market system experienced sustained and significant downturns and even came to a halt at certain times and places (Ke and Hsiao 2022). Most industries simultaneously experienced substantial declines, except for a few related to epidemic prevention, such as medicine (He et al. 2021). As a result, during the Covid-19 pandemic, the resilience to income risks of market elites is likely to have significantly decreased. Empirical research has confirmed that, during the Covid-19 pandemic in China, investment returns decreased compared to pre-pandemic levels (Zhang, Hu, and Ji 2020). This further suggests that during the pandemic, the income security of market elites in China was likely weakened.

Conversely, the sources of income security for administrative elites, which derived from the power of the redistribution system, remained largely unaffected. Furthermore, the nationwide mobilisation among government and other state sectors to tackle the pandemic indicates that the public sector was allocated more resources than usual during the pandemic (Ouyang, Zheng, and Cheng 2020), therefore reinforcing the strength of the redistribution system. In summary, the conditions supporting the resilience to income risks of market elites, which is provided by a smoothly operating market, were significantly damaged or even ceased to exist during the Covid-19 pandemic in China. Thus, stable salaries, which are provided by the redistribution system, became the only pillar supporting income security, something that administrative elites have but market elites lack. As a result, the extent of income loss for the two types of elites are likely to have diverged significantly. Based on the above analysis, we proposed the following hypothesis:

Hypothesis 1: Compared to market elites, administrative elites suffered less income loss during the Covid-19 pandemic.

As mentioned earlier, the redistribution system offers strong protection against income loss. As a result, administrative elites, who occupy high positions in the redistribution system, have the strongest resilience against income loss among all social groups in China. As for the non-elite group, they mainly consist of employees of certain organisations and agricultural labourers. On the one hand, employees often have labour contracts and social insurance, which provided them with some protection against income loss during the pandemic. On the other hand, even during the pandemic, because people still needed an adequate food supply, and combined with the local economy in rural areas, agriculture has not experienced significant downturn (Shao and Zhou 2024). Additionally, because farmers have their own land, they did not face as much risk of bankruptcy during the pandemic, which also helped to prevent a significant drop in their income (Bai, Cao, and Liu 2022). In summary, while the protection against income loss available to non-elite groups may not be as strong as that of administrative elites, they still possess several means to mitigate the extent of their income loss. However, the majority of market elites are entrepreneurs who lack the protection and buffer provided by labour contracts and social insurance. As business owners, they have to bear the consequences of their enterprises’ profits and losses, and they thus faced the direct impact of general market downturns in almost all non-agricultural industries and even market halts during the pandemic. Therefore, the extent to which the income of market elites was damaged was likely to be not only higher than that of administrative elites, but even higher than that of the non-elite group. Therefore, we proposed the following two hypotheses:

Hypothesis 2: Compared to non-elite groups, administrative elites experienced less income loss during the Covid-19 pandemic.

Hypothesis 3: Compared to non-elite groups, market elites suffered greater income loss during the Covid-19 pandemic.

Data, variables, and statistical models

Data

This study uses data from the 2021 wave of the China General Social Survey (CGSS) for analysis. As one of China’s earliest nationwide, comprehensive, and continuing academic survey projects, CGSS employs a combination of multi-stage stratified sampling and face-to-face interviews, widely acknowledged in academia for its data quality. Despite being conducted during the Covid-19 pandemic in 2021, the survey systematically and comprehensively collected information at multiple levels from samples drawn from 19 provinces.

Given that the focus of this paper is the difference in income loss between the two types of elites, as well as their respective differences relative to non-elite groups during Covid-19, non-working individuals such as retirees, the long-term unemployed, and students were excluded from the analysis.[4] Then, to more accurately identify the two elite types, we removed from the sample the respondents who were simultaneously classified as administrative elites and market elites or those who themselves were classified as one type of elite while their spouses were classified as the other type of elite. After these steps, 4,355 out of 8,148 observations were removed from the sample. Finally, observations with incomplete information on the variables of interest were removed, resulting in an analytical sample of 3,607 individuals.

Variables

Outcome variable: Extent of income loss

This variable is measured by a question in CGSS 2021 asking the respondents, “How has the income of your family changed compared to that before Covid-19?” Without changing the distribution pattern, we recoded it into a five-point variable with values ranging from -2 to 2, which is treated as a continuous variable, with higher numerical values indicating more severe income loss.

Main explanatory variables: Elite type

As outlined in the introduction, we define administrative elites as individuals who occupy managerial roles or hold administrative-level positions within Party and government organisations, public institutions, or SOEs; as for market elites, apart from private business owners, senior managers and professionals working in the private sector are also treated as part of this group for their high level of authority and autonomy in the workplace. These definitions are not only proposed by Liu (2021) but are also widely used in other studies of elites in China (Lü and Fan 2016; Zhu 2017).

Control variables

This study incorporates several factors that potentially affect income loss during the Covid-19 pandemic as control variables in the model. These factors include gender (1 = male, 0 = female), hukou 戶口 type (1 = non-agricultural, 0 = agricultural), place of residence (1 = urban, 0 = rural), housing status (1 = houseowner, 0 = non-houseowner), CCP membership (1 = CCP member, 0 = non-CCP member), marital status (1 = married, 0 = unmarried), as well as years of education, age, social support, health status, household income (logarithmic), and subjective class identification. Additionally, we controlled for regional fixed effects and whether the individual was located in the epicentre of the pandemic, Hubei Province.

Model setting

This study focuses on examining the income loss experienced by different elite groups during the Covid-19 pandemic. The outcome variable, “Income Loss,” was treated as a continuous variable, and multiple linear regressions (ordinary least squares, OLS) were employed for analysis:

\[ \text{Income_Loss}_i = \alpha_1 + \beta \cdot \text{Elite_Status}_i + \theta X_i + \epsilon_i \]In the equations above, Income_Lossi represents the extent of income loss experienced by individual i during the pandemic. Elite_Statusi denotes whether individual i belongs to the market elite, administrative elite, or non-elite group. Xi represents a set of control variables. ɛi represents the error term. The remaining Greek letters represent the regression coefficients. Of particular interest are the coefficients for elite status (β), which are used to test our hypotheses.

Research findings

Cross-year variations in income among different elite groups

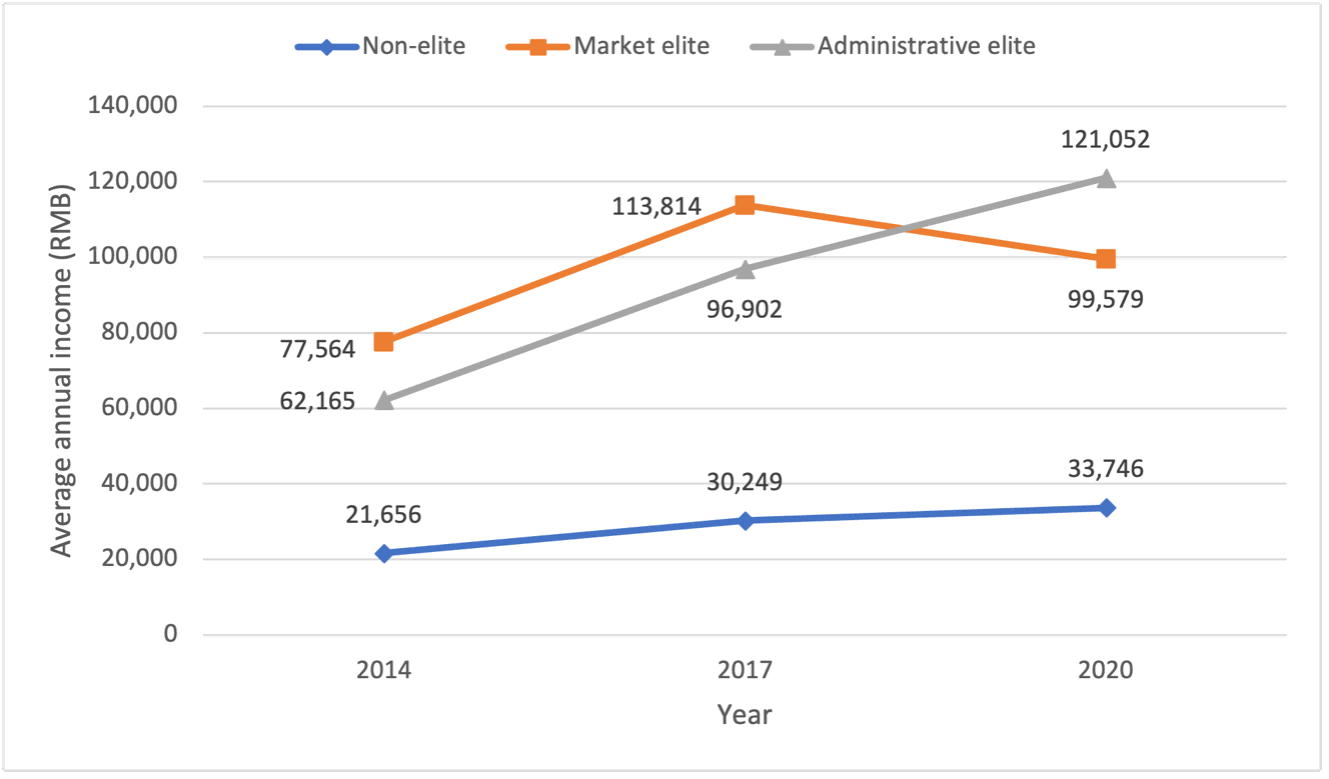

First, this paper provides a descriptive analysis of the absolute variations of personal income among market elites, administrative elites, and the non-elite group using data from the 2015, 2018, and 2021 waves of the Chinese General Social Survey. While CGSS is not a longitudinal survey, meaning that it does not survey the same respondents across waves, its nationwide representativeness renders the observed trends meaningful as a reference. As illustrated in Figure 1, in 2015 and 2018, the income levels of administrative elites and market elites were relatively close, with the latter slightly higher than the former, while both types of elites significantly out-earned the non-elite groups.[5]

However, in 2021, after over a year of the Covid-19 pandemic, market elites experienced a substantial decline in their income, in stark contrast to administrative elites, who maintained income growth as in previous years. These empirical findings provided initial evidence for the research questions in this paper, suggesting that during Covid-19, there may have been a pronounced divergence in income loss among the different elites.

Figure 1. Income variations among different elite groups, 2015-2021

Source: CGSS 2015, CGSS 2018, and CGSS 2021.

Descriptive statistics

The descriptive statistics for the variables are presented in Table 1. First, it was evident that, on average, Chinese households experienced income loss during the pandemic. In the sample, approximately 5% were classified as market elites, while over 6% were categorised as administrative elites. Furthermore, when summarising the income loss in different groups, administrative elites experienced significantly less income loss compared to non-elites (0.040 vs. 0.398), while market elites, who had exhibited the fastest income growth before Covid-19, found it more challenging to safeguard their income compared to non-elites in the pandemic (0.606 vs 0.398).

Table 1. Descriptive statistics and mean difference test

| Panel A descriptive statistics | |||||||||

| Variables | Mean | SD | Min | Max | |||||

| Income loss | 0.386 | 0.840 | -2 | 2 | |||||

| Market elite | 0.050 | 0.218 | 0 | 1 | |||||

| Administrative elite | 0.063 | 0.242 | 0 | 1 | |||||

| Years of education | 10.23 | 4.366 | 0 | 19 | |||||

| Male | 0.535 | 0.499 | 0 | 1 | |||||

| Age | 46.09 | 13.54 | 18 | 89 | |||||

| CCP member | 0.121 | 0.326 | 0 | 1 | |||||

| Homeowner | 0.954 | 0.210 | 0 | 1 | |||||

| Log (household income) | 10.97 | 1.719 | 0 | 16.12 | |||||

| Urban residence | 0.442 | 0.497 | 0 | 1 | |||||

| Married | 0.772 | 0.419 | 0 | 1 | |||||

| Non-agricultural hukou | 0.380 | 0.485 | 0 | 1 | |||||

| Class identification | 4.304 | 1.805 | 1 | 10 | |||||

| Health status | 3.695 | 0.973 | 1 | 5 | |||||

| Social support | 2.335 | 0.867 | 1 | 5 | |||||

| Epidemic centre | 0.070 | 0.254 | 0 | 1 | |||||

| N | 3,607 | 3,607 | 3,607 | 3,607 | |||||

| Panel B mean difference test | |||||||||

| Testing method | Outcome variable | Non-elite group | Administrative elites | Market elites | Difference | ||||

| T-test of mean difference | Extent of income loss | 0.398 | 0.040 | 0.358*** | |||||

| 0.398 | 0.606 | -0.208*** | |||||||

Note: ***p < 0.01, **p < 0.05, *p < 0.1.

Source: CGSS 2021.

Baseline regressions

The results of the baseline regressions are presented in Table 2. Model 1 included only control variables, Model 2 contrasted market and administrative elites with non-elite groups within the same regression, and Model 3 contrasted the two types of elites directly after dropping respondents of the non-elite group from the sample. In Model 1, individuals with higher levels of education, older age, Communist Party membership, higher family income, non-agricultural hukou, stronger social support, better health, and higher subjective class identification experienced less income loss during the pandemic, echoing prior research findings that disadvantaged groups suffered more during Covid-19 (Almeida et al. 2021).

Controlling for the above factors, Models 2 and 3 revealed that, compared to the non-elite group, market elites experienced significantly greater income loss during the pandemic. In contrast, administrative elites experienced significantly lower income loss compared with either market elites or the non-elite group. Hence, hypotheses 1, 2, and 3 were all supported.

Table 2. Income loss experienced by different types of elites during Covid-19

| Variables | Model 1 | Model 2 | Model 3 |

| Income loss | |||

| Market elite vs non-elite | 0.241*** | ||

| (0.077) | |||

| Administrative elite vs non-elite | -0.192*** | ||

| (0.049) | |||

| Administrative elite vs market elite | -0.448*** | ||

| (0.097) | |||

| Years of education | -0.013*** | -0.011*** | -0.038** |

| (0.004) | (0.004) | (0.019) | |

| Male | 0.032 | 0.031 | -0.052 |

| (0.028) | (0.027) | (0.086) | |

| Age | -0.005*** | -0.005*** | 0.003 |

| (0.001) | (0.001) | (0.005) | |

| CCP member | -0.101** | -0.064 | 0.038 |

| (0.040) | (0.040) | (0.083) | |

| Household income (logarithmic) | -0.028*** | -0.027*** | -0.022 |

| (0.011) | (0.011) | (0.030) | |

| Urban residence | -0.041 | -0.039 | 0.219 |

| (0.035) | (0.035) | (0.138) | |

| Married | 0.115*** | 0.116*** | 0.031 |

| (0.033) | (0.033) | (0.111) | |

| Homeowner | 0.024 | 0.030 | 0.167 |

| (0.065) | (0.065) | (0.181) | |

| Non-agricultural hukou | -0.152*** | -0.147*** | 0.116 |

| (0.035) | (0.035) | (0.117) | |

| Epidemic centre | 0.233*** | 0.226*** | 0.265 |

| (0.063) | (0.063) | (0.250) | |

| Health status | -0.036** | -0.039*** | -0.027 |

| (0.015) | (0.015) | (0.051) | |

| Social support | -0.222*** | -0.221*** | -0.149*** |

| (0.017) | (0.017) | (0.052) | |

| Class identification | -0.025*** | -0.025*** | -0.023 |

| (0.008) | (0.008) | (0.028) | |

| Region | Controlled | Controlled | Controlled |

| Constant | 1.684*** | 1.640*** | 1.439** |

| (0.169) | (0.169) | (0.566) | |

| N | 3,607 | 3,607 | 406 |

| R2 | 0.102 | 0.109 | 0.177 |

Note: Robust standard errors in parentheses; ***p < 0.01, **p < 0.05, *p < 0.1; same below.

Source: CGSS 2021.

To ensure the robustness of our findings, we conducted a series of robustness checks. First, we utilised inverse probability weighting to mitigate sample selection bias. After employing the weights, we re-ran Model 2 in Table 2 and found that, while controlling for other factors, the extent of income loss for market elites increased by 0.259 (p < 0.01) compared to non-elites, whereas administrative elites experienced a decrease in income loss of 0.230 (p < 0.01), which confirms our findings.

Additionally, we replaced the core explanatory variables to check the robustness of the findings. Specifically, if the differences of income loss observed in the survey are truly due to differences in the market system and the redistribution system during Covid-19, the findings in the baseline regression should still hold if we expand the analysis from comparing the two types of elites to comparing all state sector employees and private sector labourers (including the self-employed). Indeed, we found that state sector employees in general experienced significantly lower income loss during the pandemic compared to others (β = -0.301, p < 0.01), while the private sector employees suffered notably higher income loss compared to others (β = 0.459, p < 0.01).

Finally, since the outcome variable in our study is of an ordinal nature, we replaced OLS with the Ordinal Logistic Model and repeated the analysis in Table 2. The directions and significance levels of the core explanatory variables all remained the same as in baseline regression, reaffirming the robustness of our findings.

Moderation and mediation

Based on the above findings, we moved further to discussing the moderating and mediating mechanisms behind the difference in income loss for the two types of elites. First, as previously discussed, during the Covid-19 pandemic in China, the weakening of the market system left the redistribution system as the sole institutional support for income security. Following this logic, in places where the closure of the market system was more severe, market elites might suffer more severe income loss; on the other hand, in places where the redistribution system was further strengthened, administrative elites should be better protected from income loss.

To test the above logic, we first used the decline in foreign trade (provincial level) as an indicator of the extent of regional market closure during the pandemic (Chen 2020; Wang and Zhang 2020) and performed a moderating analysis as shown in Model 2 in Table 3. The results showed that, in places where there was a greater decline in foreign trade, market elites experienced more severe income loss, which aligned with our prediction. For the places more severely affected by Covid-19 (measured by the number of Covid-19 infections in each city), administrative elites experienced even smaller income loss, as Model 3 in Table 3 shows. This can be attributed to the fact that the state would employ administrative measures to direct more resources toward areas where the pandemic was more severe, thereby strengthening the redistribution system’s capacity to allocate resources and mobilise social forces. Consequently, in areas with more severe outbreaks of Covid-19, the enhanced redistribution system likely granted administrative elites greater income security, which was proven by statistical analysis.

Next, we introduced “type of pay” as a mediating variable to further explain how varying levels of resilience to income risks contributed to differences in income loss among different elites during the pandemic. As mentioned in the previous section, we believe that the stable salary provided by the redistribution system became the sole support for income security during Covid-19. Now, we will directly test whether it plays a pivotal role in explaining the difference in income loss between market elites and administrative elites. Drawing on existing research (Li, Liu, and Chu 2018), we categorised pay types into fixed pay (including “fixed monthly salary” and “fixed annual salary”) and non-fixed pay (including “base salary plus performance,” “hourly wage,” and so on). The former is generally considered to be associated with a higher level of resilience to income risk, while the latter is viewed as indicating a lower level of resilience to income risk (He and Long 2011). Subsequently, we employed the commonly used stepwise regression method for mediation analysis (Baron and Kenny 1986). The results, as shown in Model 1, 4, and 5 in Table 3, indicate that administrative elites are more likely than market elites to receive fixed pay. Moreover, the stronger the resilience to income risk represented by fixed pay, the lower the extent of income loss during the pandemic. Moreover, compared with Model 1, with the addition of the mediating variable in Model 5, both the absolute value and significance level of the coefficients for the two kinds of elites significantly decreased. This suggests that type of pay plays a partial mediating role between elite type and the extent of income loss. The findings above suggest that access to the income security of fixed pay, which was provided by the redistribution system, was a key factor in the divergent income losses of different elites during the pandemic. Also, the KHB decomposition[6] for mediation effect showed essentially the same results, indicating that the type of pay played a mediating role of 31% and 34% between elite status and income loss for administrative elites and market elites, respectively, as shown in Table 4.

Table 3. Moderation and mediation mechanism of income loss experienced by different types of elites during Covid-19

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

| Income loss | Income loss | Income loss | Fixed pay | Income loss | |

| Market elite vs non-elite | 0.241*** | 0.355*** | 0.239*** | -1.887*** | 0.167** |

| (0.077) | (0.090) | (0.078) | (0.288) | (0.078) | |

| Administrative elite vs non-elite | -0.192*** | -0.167*** | -0.187*** | 0.985*** | -0.126** |

| (0.049) | (0.056) | (0.049) | (0.181) | (0.049) | |

| Foreign trade decline rate | -0.209 | ||||

| (0.238) | |||||

| Market elite × foreign trade decline rate | 1.943** | ||||

| (0.903) | |||||

| Administrative elite × foreign trade decline rate | 0.528 | ||||

| (0.526) | |||||

| Severity of Covid-19 | 0.001 | ||||

| (0.004) | |||||

| Market elite × severity of Covid-19 | 0.002 | ||||

| (0.014) | |||||

| Administrative elite × severity of Covid-19 | -0.011** | ||||

| (0.005) | |||||

| Fixed pay | -0.282*** | ||||

| (0.031) | |||||

| Region | Controlled | Controlled | Controlled | Controlled | Controlled |

| Control variables | Controlled | Controlled | Controlled | Controlled | Controlled |

| Constant | 1.640*** | 1.633*** | 1.642*** | -2.680*** | 1.654*** |

| (0.169) | (0.169) | (0.169) | (0.524) | (0.165) | |

| N | 3,607 | 3,607 | 3,607 | 3,607 | 3,607 |

| R2/ Pseudo R2 | 0.109 | 0.111 | 0.109 | 0.178 | 0.127 |

Note: Model 4 is the Logit model with Pseudo R2; control variables are the same as in Table 2, same below. Source: CGSS 2021.

Table 4. KHB decomposition for the mediating effect

| Outcome variable | Income loss | |

| Control variables | Same as baseline regression | |

| Mediating variable | Type of pay (fixed pay or not) | |

| Explanatory variables | Market elite | Administrative elite |

| Total effect | 0.241*** | -0.192*** |

| Direct effect | 0.167** | -0.126** |

| Indirect effect | 0.074*** | -0.066*** |

| Contribution rate | 30.53% | 34.39% |

Source: CGSS 2021.

Further analysis: Spousal factors and income volatility

Incorporating spousal factors

In the baseline regressions section, the explanatory variables were operationalised using individual-level employment status, while the outcome variable is household income loss. This was due to data limitations, but we believe that it does not fundamentally challenge our findings, because individual income and household income are highly correlated. Individual characteristics can significantly impact household income, and changes in household income can effectively reflect changes in individual income (Wang and Zhou 2010). In this section, nevertheless, we will explore whether our findings hold from a more detailed perspective by incorporating the elite status of the spouse.

Specifically, we first restricted the analytical sample to 2,069 individuals who were married to spouses who were also employed. Then, we conducted a series of statistical analyses, the results of which are shown in Table 5. Model 1 demonstrated that if at least one spouse in the family was an administrative (or market) elite (we refer to such families as market/administrative elite family), the degree of household income loss decreased (or increased). This reaffirms the robustness of the results in the baseline regressions, in other words that administrative (or market) elites experienced less (or more) income loss compared to non-elites. Model 2, however, offered new insights. Comparing households where one person in the family was a market/administrative elite (referred to as a single market/administrative elite family) to households where both spouses were market/administrative elites (referred to as a double market/administrative elite family), the latter type of household was more/less likely to experience income loss. In other words, there appears to be a certain “gradational effect” in both the protective effect of administrative elites and the detrimental effect of market elites on household income.

Table 5. Family elite structure and household income loss during Covid-19

| Variables | Model 1 | Model 2 |

| Income loss | ||

| Market elite family vs non-elite family | 0.241*** | |

| (0.088) | ||

| Administrative elite family vs non-elite family | -0.201*** | |

| (0.056) | ||

| Double market elite family vs non-elite family | 0.379** | |

| (0.188) | ||

| Single market elite family vs non-elite family | 0.200** | |

| (0.098) | ||

| Single administrative elite family vs non-elite family | -0.185*** | |

| (0.061) | ||

| Double administrative elite family vs non-elite family | -0.286*** | |

| (0.068) | ||

| Region | Controlled | Controlled |

| Control variables | Controlled | Controlled |

| Constant | 2.116*** | 2.111*** |

| (0.222) | (0.222) | |

| N | 2,069 | 2,069 |

| R2 | 0.124 | 0.125 |

Source: CGSS 2021.

Revisiting income volatility

In the baseline regressions section, we treated the outcome variable as a continuous spectrum of income loss and conducted analyses using multiple linear regressions. However, this approach does not allow exploration of the direction of income volatility experienced by different elites and the non-elite group during the pandemic. To address this question, the outcome variable was recoded as follows: “increased significantly” and “increased slightly” were recoded as “income improvement”; “decreased significantly” and “decreased slightly” were recoded as “income deterioration”; and “remained the same as before the pandemic” was categorised as “income stability.” Furthermore, using income stability as the reference category, a multinomial logistic regression model was estimated, the results of which are presented in Table 6.

Compared to the non-elite group, market elites had a significantly higher likelihood of experiencing income deterioration compared to keeping their income stable during the Covid-19 pandemic. In contrast, administrative elites had a significantly lower likelihood of experiencing income deterioration, which aligns perfectly with the findings in the baseline regressions. Worth noting is that, in comparison to the non-elite group, the likelihood of income improvement among administrative elites appears to have no significant difference, but the likelihood of income improvement among market elites is significantly higher.

Combining the results from the baseline regressions, the following conclusions can be drawn: market elites experienced significant income volatility during Covid-19, and they were less likely to maintain a stable income compared to other groups. On average, market elites experienced significant income losses during the pandemic. However, there was a small subset of market elites who capitalised on unique business opportunities during the pandemic, resulting in income improvement. Specifically, in the analytical sample, the ratio of market elites with income deterioration to those with income stability is 1.6, which is significantly higher than the corresponding ratios for administrative elites (0.15) and the non-elite group (0.67). On the other hand, the ratio of entrepreneurs with income improvement to those with income stability is 0.4, also significantly higher than the corresponding ratios for administrative elites (0.13) and the non-elite group (0.15).

The findings from the multinomial logistic regression model indicate that, even in the most adverse market conditions, when the majority of market elites were experiencing losses, a portion of market elites managed to seize and exploit opportunities that were not readily available to other social groups, primarily by leveraging their entrepreneurial skills, as mentioned in the theoretical background section.

Table 6. Multinomial logit model for income volatility of different elite groups during Covid-19

| Variables | Reference category = income stability | |

| Income improvement | Income deterioration | |

| Market elite vs non-elite | 0.825*** | 0.939*** |

| (0.259) | (0.176) | |

| Administrative elite vs non-elite | -0.174 | -1.160*** |

| (0.247) | (0.234) | |

| Region | Controlled | Controlled |

| Control variables | Controlled | Controlled |

| Constant | -2.329*** | 2.531*** |

| (0.788) | (0.447) | |

| N | 3,607 | 3,607 |

| Pseudo R2 | 0.076 | 0.076 |

Source: CGSS 2021.

Conclusion and discussions

The Covid-19 pandemic has had crucial social impact in China, but the impact was not equal for everyone. Existing research has demonstrated that vulnerable populations suffered disproportionately severe income loss during the pandemic. However, there has been a lack of studies regarding the heterogeneity of income loss within elite groups amidst the pandemic. Building upon this gap in the literature, this study focused on the difference in income loss among administrative elites and market elites during the Covid-19 pandemic. We argue that while both types of elites typically enjoy a high level of resilience to income risks in normal times, their resilience comes from different institutional sources. For administrative elites, the stable salary offered by the powerful redistribution system provides them with income security, while the income security for market elites as a whole comes from their entrepreneurial skills and various sources of income supported by a well-functioning market system. However, under the conditions of the Covid-19 pandemic, with the functioning of the market system being impaired, the factors provided by the redistribution system became the sole pillar of resilience to income risk. Consequently, administrative elites and market elites likely faced completely different circumstances in terms of income loss during the pandemic.

Empirically, through an analysis of CGSS 2021 data, we found that while the pandemic resulted in a universal experience of income loss across Chinese society, market elites suffered a more pronounced decline, whereas administrative elites experienced a more modest decrease. In other words, administrative elites enjoyed significantly more advantage in safeguarding their income during Covid-19 than market elites, which is consistent with our theoretical arguments. Moreover, in regions characterised by higher foreign trade decline, where market closure was severe, market elites experienced further income loss, while administrative elites in areas with more severe Covid-19 outbreaks, where the redistribution system was further strengthened, experienced less income loss. Mediation analysis showed that compared with the non-elite group, administrative elites had a higher probability of fixed pay, which is the most important source of resilience to income risk during the Covid-19 pandemic, while market elites had a lower probability of having it. These disparities underscored the differing sources of income security between the two types of elites and the changes in the effectiveness of these sources during the pandemic.

We believe that the findings of this study provide empirical evidence for the significant role of sector segregation in social stratification in today’s China. In traditional class schemas, administrative elites and market elites belong to the same social class: they share similar International Socioeconomic Index (ISEI) of occupational status scores, possessing significantly higher absolute incomes, educational levels, and social prestige compared to others. The stark difference in income losses between these two types of elites during the pandemic can be attributed to the fact that one group is in the public sector, with the redistribution system providing a safety net for their income, while the other is in the private sector, lacking such rigid guarantees although they have their own sources of income security during normal times. In other words, in China, the disparity between the public and private sectors in terms of providing labour security is an important facet of sector segregation. The term “labour security” was first proposed by the economist Guy Standing. According to Standing (1995), labour security encompasses not only job stability but also multiple dimensions, including the stability of different professions in response to labour market fluctuations, protection from all kinds of workplace harm, and so on. It effectively reflects an individual’s occupational resilience when facing significant external shocks. Subsequently, Standing further applied the perspective of labour security to analyse all professions and proposed a stratification of occupations, which is the foundation for modern social stratification, based on levels of labour security (2008). Therefore, the significance of this study extends far beyond a mere discussion of the experiences of different elites in the unique context of the Covid-19 pandemic. Scholars have observed a trend toward public sector in employment choices across Chinese society in recent years: there has been a surge in interest in civil service careers among the youth and a growing preference among university graduates for employment within government agencies, public institutions, and state-owned enterprises in recent years (Li, Xiang, and Gui 2021). Behind all these trends, the higher levels of security associated with positions within the redistribution system act as a crucial factor.

Furthermore, the diverging income losses experienced by administrative and market elites during Covid-19 may have long-term effects. For market elites, these setbacks may influence their confidence in government and market institutions, subsequently affecting their behaviour in the realms of business management and other facets of social engagement. However, administrative elites become increasingly aware of their advantageous position and make efforts to consolidate their privileges. Given the substantial societal influence wielded by elite groups in comparison to the general populace, the anticipated shifts in their attitudes and behaviours have the potential to engender profound and lasting effects on Chinese society. Further research is warranted to explore such issues in depth.

Nevertheless, when reevaluating this issue from the perspective of income volatility, market elites were more likely to witness both deteriorations and improvements in income during the pandemic compared to non-elites. Conversely, although administrative elites faced a lower likelihood of income deterioration compared to non-elite groups, their prospects for income improvement showed no significant difference. In other words, despite the overarching power of structural factors driving income changes during the Covid-19 pandemic, the entrepreneurial skills typical of market elites continued to demonstrate its significance.

This study also has some limitations. Due to the cross-sectional nature of the CGSS data, the measurement of income loss relies solely on subjective measurements, as it is not possible to track objective income changes for the same individuals before and after the pandemic, potentially affecting measurement validity. However, given the current circumstances, this is the only publicly available nationally representative data in China that surveyed income changes during the pandemic, so this variable was still used to measure income loss during Covid-19. As more survey data covering the period of the Covid-19 pandemic become available, we look forward to scholars using panel data to test the findings of this study.

While the Covid-19 pandemic is receding, we consider that, as long as China is still experiencing the transition from a society of growth to a society of stasis, where high-quality employment opportunities is hard to get while the aspirations of the middle class to maintain their status and the desire for upward social mobility among the disadvantaged remain strong, security shaped by the sector segregations will always be an important stratification standard and can help reach a deeper understanding of today’s Chinese society.

Acknowledgements

We are grateful for the insightful suggestions and guidances from Xiaobin He, Jingming Liu and Lu Zheng. Earlier versions of this paper were presented at the Panel of Social Stratification and Mobility in the 2023 Annual Conference of the Chinese Sociological Association, as well as the 2023 Lilin Forum of Youth Scholars held by the China Academy of Social Sciences. We would like to express our gratitude toward the reviewers at the conferences and their comments.

Manuscript received on 18 March 2024. Accepted on 7 October 2024.

References

ALMEIDA, Vanda, Salvador BARRIOS, Michael CHRISTL, Silvia de POLI, Alberto TUMINO, and Wouter van der WIELEN. 2021. “The Impact of Covid-19 on Households’ Income in the EU.” The Journal of Economic Inequality 19(3): 413-31.

AMSDEN, Alice H., Alisa DiCAPRIO, and James A. ROBINSON (eds.). 2012. The Role of Elites in Economic Development. Oxford: Oxford University Press.

BARON, Reuben M., and David A. KENNY. 1986. “The Moderator-mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations.” Journal of Personality and Social Psychology 51(6): 1173-82.

BAI, Yunli 白雲麗, CAO Yueming 曹月明, LIU Chengfang 劉承芳, and ZHANG Linxiu 張林秀. 2022. “農業部門就業緩沖作用的再認識: 來自新冠肺炎疫情前後農村勞動力就業的證據” (Nongye bumen jiuye huanchong zuoyong de zairenshi: Laizi xinguan feiyan yiqing qianhou nongcun laodongli jiuye de zhengju, A recognition on the buffer role of the agricultural sector: Evidence from off-farm employment of rural labor force during the Covid-19 pandemic). Zhongguo nongcun jingji (中國農村經濟) 6: 65-87.

BIAN, Yanjie 邊燕傑, and ZHANG Zhanxin 張展新. 2002. “市場化與收入分配: 對1988年和1995年城市住戶收入調查的分析” (Shichanghua yu shouru fenpei: Dui 1988 nian he 1995 nian chengshi zhuhu shouru diaocha de fenxi, Marketisation and income distribution: Analysing the 1988 and 1995 urban household income surveys). Zhongguo shehui kexue (中國社會科學) 5: 97-111.

BREWER, Mike, and Iva Valentinova TASSEVA. 2021. “Did the UK Policy Response to Covid-19 Protect Household Incomes?” The Journal of Economic Inequality 19(3): 433-58.

BRODEUR, Abel, David GRAY, Anik ISLAM, and Suraiya BHUIYAN. 2021. “A Literature Review of the Economics of Covid-19.” Journal of Economic Surveys 35(4): 1007-44.

BURKI, Talha. 2022. “Dynamic Zero Covid Policy in the Fight against Covid.” The Lancet Respiratory Medicine 10(6). https://doi.org/10.1016/S2213-2600(22)00142-4

CHEN, Fenggong 陳奉功. 2020. “新冠肺炎疫情對我國企業的異質性影響: 基於股價波動視角的實證研究” (Xinguan feiyan yiqing dui woguo qiye de yizhixing yingxiang: Jiyu gujia bodong shijiao de shizheng yanjiu, The heterogeneous impact of Covid-19 on Chinese enterprises: Empirical research based on the perspective of stock price fluctuations). Gongye jishu jingji (工業技術經濟) 39(10): 3-14.

CHEN, Haiwei 陳海威, and TIAN Kan 田侃. 2007. “我國基本公共服務均等化問題探討” (Woguo jiben gonggong fuwu jundenghua wenti tantao, Discussion on equalisation of basic public services in China). Zhongzhou xuekan (中州學刊) 3: 31-4.

CI, Xinxin 慈鑫鑫, LIU Pengcheng 劉鵬程, and HAN Guixin 韓貴鑫. 2021. “創業者能獲得高收入嗎?” (Chuangyezhe neng huode gaoshouru ma?, Can entrepreneurs get high income?). Changchun ligong daxue xuebao (shehui kexue ban) (長春理工大學學報(社會科學版)) 34(2): 126-34.

ELIAS, Amanuel, Jehonathan BEN, Fethi MANSOURI, and Yin PARADIES. 2021. “Racism and Nationalism during and beyond the Covid-19 Pandemic.” In John SOLOMOS (ed.), Race and Ethnicity in Pandemic Times. London: Routledge. 65-75.

GAN, Chunhui 幹春暉, ZHENG Ruogu 鄭若穀, and YU Dianfan 余典範. 2011. “中國產業結構變遷對經濟增長和波動的影響” (Zhongguo chanye jiegou bianqian dui jingji zengzhang he bodong de yingxiang, An empirical study on the effects of industrial structure on economic growth and fluctuations in China). Jingji yanjiu (經濟研究) 46(5): 4-16.

HE, Pinglin, Hanlu NIU, Zhe SUN, and Tao LI. 2021. “Accounting Index of Covid-19 Impact on Chinese Industries: A Case Study Using Big Data Portrait Analysis.” In Yezhou SHA, and Susan Sunila SHARMA (eds.), Research on Pandemics: Lessons from an Economic and Finance Perspective. London: Routledge. 200-17.

HE, Wei 賀偉, and LONG Lirong 龍立榮. 2011. “薪酬體系框架與考核方式對個人績效薪酬選擇的影響” (Xinchou tixi kuangjia yu kaohe fangshi dui geren jixiao xinchou xuanze de yingxiang, The effects of pay system framework and appraisal style on individual performance pay choices). Xinli xuebao (心理學報) 43(10): 1198-210.

IOANNIDIS, John P. A., Francesco ZONTA, and Michael LEVITT. 2023. “Estimates of Covid‐19 Deaths in Mainland China after Abandoning Zero Covid Policy.” European Journal of Clinical Investigation 53(4). https://doi.org/10.1111/eci.13956

JU, Xiaosheng 鞠曉生, LU Di 盧荻, and YU Yihua 虞義華. 2013. “融資約束, 營運資本管理與企業創新可持續性” (Rongzi yueshu, yingyun ziben guanli yu qiye chuangxin kechixuxing, Financing constraints, working capital management, and the persistence of firm innovation). Jingji yanjiu (經濟研究) 48(1): 4-16.

KANSIIME, Monica K., Justice A. TAMBO, Idah MUGAMBI, Mary BUNDI, Augustine KARA, and Charles OWUOR. 2021. “Covid-19 Implications on Household Income and Food Security in Kenya and Uganda: Findings from a Rapid Assessment.” World development 137. https://doi.org/10.1016/j.worlddev.2020.105199

KE, Xiao, and Cheng HSIAO. 2022. “Economic Impact of the Most Drastic Lockdown during Covid‐19 Pandemic: The Experience of Hubei, China.” Journal of Applied Econometrics 37(1): 187-209.

KOHLER, Ulrich, Kristian Bernt KARLSON, and Anders HOLM. 2011. “Comparing Coefficients of Nested Nonlinear Probability Models.” The Stata Journal 11(3): 420-38.

LI, Jie 李傑, LIU Lu 劉露, and Chao-Hsien CHU. 2018. “P2P網絡借貸借款人違約風險影響因素研究” (P2P wangluo jiedai jiekuanren weiyue fengxian yingxiang yinsu yanjiu, Research on the influencing factors of default risk of P2P network lending borrowers). Shangye yanjiu (商業研究) 9: 45-54.

LI, Lulu 李路路, QIN Guangqiang 秦廣強, and CHEN Jianwei 陳建偉. 2012. “權威階層體系的構建: 基於工作狀況和組織權威的分析” (Quanwei jieceng tixi de goujian: Jiyu gongzuo zhuangkuang he zuzhi quanwei de fenxi, The construction of authority-based stratum system: An analysis based on work situation and organisational authority). Shehuixue yanjiu (社會學研究) 27(6): 46-76.

LI, Qiang 李強. 2019. 當代中國社會分層 (Dangdai Zhongguo shehui fenceng, Social stratification in contemporary China). Beijing: Shenghuo shudian chubanshe.

LI, Xiuwen 李秀玫, XIANG Ganyezi 向橄葉子, and GUI Yong 桂勇. 2021. “在物質主義和後物質主義之間: 後疫情時代大學生就業態度的變化” (Zai wuzhi zhuyi he houwuzhi zhuyi zhijian: Hou yiqing shidai daxuesheng jiuye taidu de bianhua, Between materialism and post-materialism: Changes in the job attitudes of graduates in post pandemic age). Wenhua zongheng (文化縱橫) 1: 120-9.

LIU, Xin 劉欣. 2018. “協調機制, 支配結構與收入分配: 中國轉型社會的階層結構” (Xietiao jizhi, zhipei jiegou yu shouru fenpei: Zhongguo zhuanxing shehui de jieceng jiegou, Coordination, domination, and income distribution: The structure of social stratification in transitional China). Shehuixue yanjiu (社會學研究) 33(1): 89-115.

——. 2021. “英才之路: 通往轉型社會二元精英地位的雙重路徑” (Yingcai zhi lu: Tong wang zhuanxing shehui eryuan jingying diwei de shuangchong lujing, The road to the elite: Dual path to the divided elite positions in transitional China). Shehuixue yanjiu (社會學研究) 36(4): 159-81.

LIU, Zhiguo 劉志國, and James MA. 2016. “勞動力市場的部門分割與體制內就業優勢研究” (Laodongli shichang de bumen fenge yu tizhinei jiuye youshi yanjiu, Labour market sector segmentation and the advantage of employment in-system). Zhongguo renkou kexue (中國人口科學) 4: 85-95.

LÜ, Peng 呂鵬, and FAN Xiaoguang 范曉光. 2016. “中國精英地位代際再生產的雙軌路徑(1978-2010).” (Zhongguo jingying diwei daiji zaishengchan de shuanggui lujing (1978-2010), The dual-track intergenerational reproduction of state and market elites in China: 1978-2010). Shehuixue yanjiu (社會學研究) 31(5): 114-38.

MERTON, Robert K. 1968. “The Matthew Effect in Science: The Reward and Communication Systems of Science are Considered.” Science: 56-63.

NAU, Michael. 2013. “Economic Elites, Investments, and Income Inequality.” Social Forces 92(2): 437-61.

NEE, Victor. 1989. “A Theory of Market Transition: From Redistribution to Markets in State Socialism.” American Sociological Review 54(5): 663-81.

OUYANG, Taohua 歐陽桃花, ZHENG Shuwen 鄭舒文, and CHENG Yang 程楊. 2020. “構建重大突發公共衛生事件治理體系: 基於中國情景的案例研究” (Goujian zhongda tufa gonggong weisheng shijian zhili tixi: Jiyu Zhongguo qingjing de anli yanjiu, The construction of a governance system for large-scale public health emergency: A case study based on the Chinese scenario). Guanli shijie (管理世界) 36(8): 19-32.

QIAN, Yue, and Wen FAN. 2020. “Who Loses Income during the Covid-19 Outbreak? Evidence from China.” Research in Social Stratification and Mobility 68. https://doi.org/10.1016/j.rssm.2020.100522

RANJAN, Rajiv. 2021. “Impact of Covid-19 on Migrant Labourers of India and China.” Critical Sociology 47 (4-5): 721-6.

SHAO, Changluan 邵長銮, and ZHOU Nannan 周南南. 2024. “中國居民家庭多維相對貧困測度及收斂性研究” (Zhongguo jumin jiating duowei xiangdui pinkun cedu ji shoulianxing yanjiu, A study on multidimensional relative poverty measurement and convergence of Chinese resident households). Renkou yu shehui (人口與社會). https://kns.cnki.net/kcms/detail/32.1851.C.20241106.1546.006.html (accessed on 21 November 2024).

SOLIMANO, Andrés, and Diego AVANZINI. 2012. “The International Circulation of Elites: Knowledge, Entrepreneurial and Political.” In Alice H. AMSDEN, Alisa DiCAPRIO, and James A. ROBINSON (eds.), The Role of Elites in Economic Development. Oxford: Oxford University Press. 53-86.

STANDING, Guy. 1995. “Labor Insecurity through Market Regulation: Legacy of the 1980s, Challenge for the 1990s.” In Katherine McFATE, Roger LAWSON, and William Julius WILSON (eds.), Poverty, Inequality, and the Future of Social Policy. New York: Russell Sage Foundation. 153-96.

——. 2008. “Economic Insecurity and Global Casualisation: Threat or Promise?” Social Indicators Research 88: 15-30.

SULEIMAN, Ezra N. 2015. Politics, Power, and Bureaucracy in France: The Administrative Elite. Princeton: Princeton University Press.

TAN, Ying 譚穎, and LI Xiaoying 李小瑛. 2018. “教育水準異質性與創業決策: 基於CLDS的實證分析” (Jiaoyu shuizhun yizhixing yu chuangye juece: Jiyu CLDS de shizheng fenxi, Heterogeneity of educational level and entrepreneurial decision-making: An empirical analysis based on CLDS). Xuexi yu shijian (學習與實踐) 8: 26-35.

WALDER, Andrew G. 2003. “Elite Opportunity in Transitional Economies.” American Sociological Review 68(6): 899-916.

WALDER, Andrew G., and Xiaobin HE. 2014. “Public Housing into Private Assets: Wealth Creation in Urban China.” Social Science Research 46: 85-99.

WANG, Tieshan 王鐵山, and ZHANG Qing 張青. 2020. “新冠肺炎疫情對我國外貿企業的影響及應對措施” (Xinguan feiyan yiqing dui woguo waimao qiye de yingxiang ji yingdui cuoshi, Impact of Covid-19 on China’s foreign trade enterprises and countermeasures). Jingji zongheng (經濟縱橫) 1: 23-9.

WANG, Fang 王芳, and ZHOU Xing 周興. 2010. “城鄉居民家庭收入流動與長期收入均等” (Chengxiang jumin jiating shouru liudong yu changqi shouru jundeng, Urban resident’s family income mobility and long-term income equality in China). Caijing kexue (財經科學) 3: 37-44.

WU, Cary, Zhilei SHI, Rima WILKES, Jiaji WU, Zhiwen GONG, Nengkun HE, Zang XIAO, Xiaojun ZHANG, Weijun LAI, and Dongxia ZHOU. 2021. “Chinese Citizen Satisfaction with Government Performance during Covid-19.” Journal of Contemporary China 30(132): 930-44.

ZHANG, Dayong, Min HU, and Qiang JI. 2020. “Financial Markets under the Global Pandemic of Covid-19.” Finance Research Letters 36. https://doi.org/10.1016/j.frl.2020.101528

ZHANG, Qi, Xinxin ZHANG, Qi CUI, Weining CAO, Ling HE, Yexin ZHOU, Xiaofan LI, and Yunpeng FAN. 2022. “The Unequal Effect of the Covid-19 Pandemic on the Labour Market and Income Inequality in China: A Multisectoral CGE Model Analysis Coupled with a Micro-simulation Approach.” International Journal of Environmental Research and Public Health 19(3). https://doi.org/10.3390/ijerph19031320

ZHU, Bin 朱斌. 2017. “中國城市居民的配偶家庭與精英地位獲得” (Zhongguo chengshi jumin de pei'ou jiating yu jingying diwei huode, Effects of spouse’s family background on elite status attainment in urban China). Shehui (社會) 37(5): 193-216.

[1] World Health Organisation, “Number of Covid-19 Deaths Reported to WHO,” https://data.who.int/dashboards/covid19/deaths (accessed on 9 September 2024).

[2] The Matthew effect refers to accumulated (dis)advantage in society. It suggests that those who start with a (dis)advantage will accrue more of that (dis)advantage. Merton (1968) first introduced this concept to social sciences.

[3] Scholars in China also define this group as “state elites,” “bureaucratic elites,” or “political elites.” In this paper, we use the term “administrative elite” because it is more commonly used to refer to elites employed within the state system and public sectors in the global context (Suleiman 2015).

[4] We also brought individuals who lost their jobs during the Covid-19 pandemic back into our analytical sample for a robustness check, controlling for their reason for unemployment. It turns out that the directions and significance levels of the regression coefficients for our primary variables of interest remained unchanged.

[5] Although CGSS 2015 and CGSS 2018 were conducted across 28 provincial units, the analysis was confined to the 19 provincial units covered by CGSS 2021 to ensure comparability.

[6] The KHB decomposition is a method of mediation analysis proposed by Kohler, Karlson, and Holm (2011). It can calculate what proportion of the correlation between the explanatory variable and the outcome variable is generated through the mediating variable.